2026 Marks One Of The Earliest Tax Season Starts In A Decade

Everyone’s favorite season gets an earlier kickoff this year. Grab a calculator or an accountant — the first day to file taxes is January 26.

Live Your Best Retirement

Fun • Funds • Fitness • Freedom

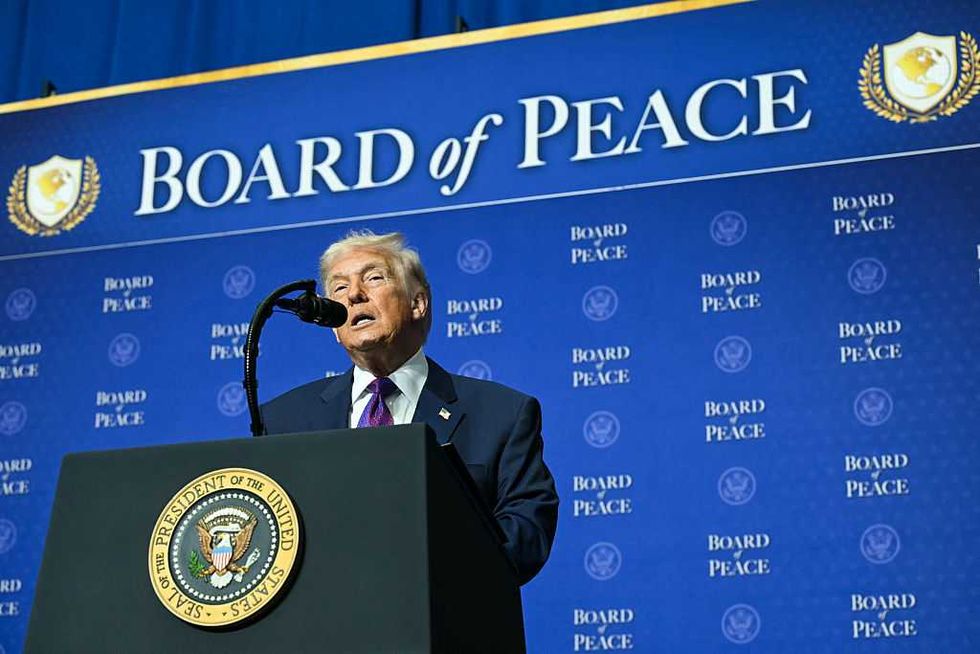

This season will look different for tax filers after the Trump administration passed the One Big Beautiful Bill, which was signed into law July 4, 2025.

Treasury Secretary Scott Bessent announced Thursday that millions of Americans may see bigger tax refunds this year thanks to the new legislation.

“The president wants to get this money into the hands of the American people as soon as possible,” Bessent said. “As withholdings are adjusted, millions will take home bigger paychecks every month this year.”

Thanks to President Trump’s One Big Beautiful Bill, millions of Americans may see the largest tax refunds of their lives in 2026. And as withholdings are adjusted, millions will take home bigger paychecks every month this year.

The President wants to get this money into the…

— Treasury Secretary Scott Bessent (@SecScottBessent) January 8, 2026

The IRS expects to receive about 164 million individual income tax returns this year, with most people filing electronically.

“President Trump is committed to the taxpayers of this country and improving upon the successful tax filing season in 2025,” Bessent said. “Prior to the passage of the One, Big, Beautiful Bill, which delivered working families tax cuts, Treasury and IRS were diligently preparing to update forms and processes for the benefit of hardworking Americans, and I am confident in our ability to deliver results and drive growth for businesses and consumers alike.”

For individuals, part of the tax cuts included in the One Big Beautiful Bill for 2026 include new tax breaks for seniors and no tax on tips, overtime, or car loan interest.

“The Internal Revenue Service is ready to help taxpayers meet their tax filing and payment obligations during the 2026 filing season,” said IRS Chief Executive Officer Frank Bisignano. “As always, the IRS workforce remains vigilant and dedicated to their mission to serve the American taxpaying public. At the same time, IRS information systems have been updated to incorporate the new tax laws and are ready to efficiently and effectively process taxpayer returns during the filing season.”

Secretary Bessent said the earlier start of the season means a quicker boost to the economy: “After this date, most of the benefits of the president’s bill will begin to materialize, presenting a major tailwind for our economy in 2026.”

The deadline for filing is April 15. The provisions of the One Big Beautiful Bill are listed here.

Originally Published at Daily Wire, Daily Signal, or The Blaze

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0