Biden’s $2 trillion deficit proves the ‘strong economy’ is a lie

Agenda-driven economists and Democratic Party mouthpieces keep repeating one claim: The economy is strong. But financial strength can often be deceiving.We’ve all seen that family with the big, beautiful home, fancy cars, designer clothes, and a country club membership. At first glance, they seem to be doing well, right? But if they’ve bought all of that with large amounts of debt, they aren’t financially secure. They are simply creating an illusion of wealth, and eventually, that catches up with them.You can’t say the economy is strong, when the fiscal foundation underneath it is full of cracks, smoke, and mirrors.That’s exactly what the U.S. government has been doing — creating the illusion of economic growth by financing it with increasing amounts of debt. From the outside, it appears as if the economy is thriving, which is why certain economists and propagandists continue to push the narrative that it’s rock-solid. However, a quick glance at the numbers tells a different story.The national debt, now nearly $35.5 trillion, is estimated to exceed 120% of GDP. Major financial entities suggest that for stability, it should be around half that amount.Under Joe Biden and Kamala Harris, credit rating agencies, which are often slow to reveal the severity of fiscal crises, have downgraded the national debt rating multiple times.We are now paying more than $1 trillion per year in interest expenses, meaning the cost of financing what we’ve already “bought” exceeds what we spend on national defense. This recalls Niall Ferguson’s maxim: “Any great power that spends more on debt service than on defense will not stay great for very long.”Adding to this growing debt burden is a massive deficit. While we have historically run large deficits relative to GDP during times of war or emergency (or so-called emergencies like COVID), the Biden-Harris administration is running wartime-level deficits — around 7%-8% of GDP, which is double the historical average — during a period without a direct war and with a supposedly strong economy.The more than $2 trillion deficit becomes even more alarming when you consider that the government took in over $5 trillion in revenue in the latest fiscal year. This is not only a record amount (compared to $3.46 trillion just five years ago), but it also exceeds the GDP of every country on Earth except the United States and China.What the government is doing mirrors the extravagant family mentioned earlier — creating the illusion of a strong economy by taking on massive debt. The deficits are inflating the appearance of growth at an enormous cost.The government has also received a boost from struggling consumers, who are taking on record levels of personal debt and dipping into their savings.You can’t say the economy is strong, when the fiscal foundation underneath it is full of cracks, smoke, and mirrors.The economists then want to change the subject, looking at increasing housing prices and stock portfolios.This isn’t the strong argument that’s being presented. Asset inflation started before the rise in the cost of living. While this benefits those who hold assets, it does nothing for wage earners struggling to cover basic living expenses. All it has done is widen the gap between the “haves” and the “have-nots,” and history shows that such a divide is unhealthy.The economy isn’t working well for everyone. Where it does appear to be working, it’s happening at a massive and unsustainable cost.What happens when the Joneses can no longer keep up with themselves? It could very well collapse the global economy. We need to confront reality instead of buying in to the illusion.

Agenda-driven economists and Democratic Party mouthpieces keep repeating one claim: The economy is strong. But financial strength can often be deceiving.

We’ve all seen that family with the big, beautiful home, fancy cars, designer clothes, and a country club membership. At first glance, they seem to be doing well, right? But if they’ve bought all of that with large amounts of debt, they aren’t financially secure. They are simply creating an illusion of wealth, and eventually, that catches up with them.

You can’t say the economy is strong, when the fiscal foundation underneath it is full of cracks, smoke, and mirrors.

That’s exactly what the U.S. government has been doing — creating the illusion of economic growth by financing it with increasing amounts of debt. From the outside, it appears as if the economy is thriving, which is why certain economists and propagandists continue to push the narrative that it’s rock-solid. However, a quick glance at the numbers tells a different story.

The national debt, now nearly $35.5 trillion, is estimated to exceed 120% of GDP. Major financial entities suggest that for stability, it should be around half that amount.

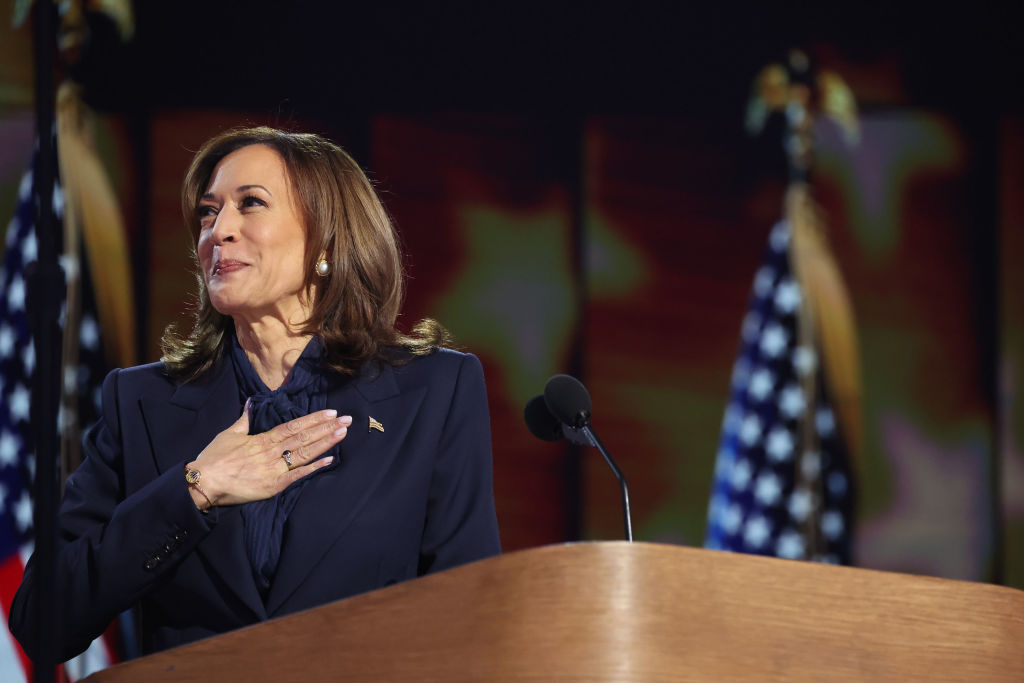

Under Joe Biden and Kamala Harris, credit rating agencies, which are often slow to reveal the severity of fiscal crises, have downgraded the national debt rating multiple times.

We are now paying more than $1 trillion per year in interest expenses, meaning the cost of financing what we’ve already “bought” exceeds what we spend on national defense. This recalls Niall Ferguson’s maxim: “Any great power that spends more on debt service than on defense will not stay great for very long.”

Adding to this growing debt burden is a massive deficit. While we have historically run large deficits relative to GDP during times of war or emergency (or so-called emergencies like COVID), the Biden-Harris administration is running wartime-level deficits — around 7%-8% of GDP, which is double the historical average — during a period without a direct war and with a supposedly strong economy.

The more than $2 trillion deficit becomes even more alarming when you consider that the government took in over $5 trillion in revenue in the latest fiscal year. This is not only a record amount (compared to $3.46 trillion just five years ago), but it also exceeds the GDP of every country on Earth except the United States and China.

What the government is doing mirrors the extravagant family mentioned earlier — creating the illusion of a strong economy by taking on massive debt. The deficits are inflating the appearance of growth at an enormous cost.

The government has also received a boost from struggling consumers, who are taking on record levels of personal debt and dipping into their savings.

You can’t say the economy is strong, when the fiscal foundation underneath it is full of cracks, smoke, and mirrors.

The economists then want to change the subject, looking at increasing housing prices and stock portfolios.

This isn’t the strong argument that’s being presented. Asset inflation started before the rise in the cost of living. While this benefits those who hold assets, it does nothing for wage earners struggling to cover basic living expenses. All it has done is widen the gap between the “haves” and the “have-nots,” and history shows that such a divide is unhealthy.

The economy isn’t working well for everyone. Where it does appear to be working, it’s happening at a massive and unsustainable cost.

What happens when the Joneses can no longer keep up with themselves? It could very well collapse the global economy. We need to confront reality instead of buying in to the illusion.

Originally Published at Daily Wire, World Net Daily, or The Blaze

What's Your Reaction?