Bill Belichick talks taxes and why athletes are flocking from Massachusetts

Bill Belichick, former New England Patriots head coach and one of the most decorated coaches in the history of the NFL, is talking taxes. According to legend, a Massachusetts law is discouraging star football players from signing with the New England Patriots.“It’s Taxachusetts,” he jested. “Even the minimum players are pretty close to a million dollars, and so once you hit that million-dollar threshold, then you pay more state tax in Massachusetts.” Rob Eno, BlazeTV Media Critic and a Massachusetts native, joins Jill Savage and the “Blaze News Tonight” panel to explain why athletes may be financially incentivized to sign with teams from states with more sensible tax codes and “why football is affected more than other professional sports.” - YouTube www.youtube.com “In November 2022, the citizens of Massachusetts actually voted to get rid of the Constitutional amendment that said they can't have a progressive income tax,” Eno explained, adding that instead, citizens opted to “have a one tax rate flat rate of 5%” as well as “a millionaire surtax of 4%.” He points to NBA forward Grant Williams as an example of why athletes are flocking away from Massachusetts. Williams, who played four seasons with the Boston Celtics, compared a Massachusetts’ salary of “$48 million with the millionaire’s tax” to the Dallas, Texas, equivalent of “$54 million.” “There's this jock tax. ... Even if you live in Dallas, you're going to pay California taxes or Boston taxes for the day games that you do there, but if you live in Massachusetts or if you work for the Boston Celtics or you work for the New England Patriots and you come to Dallas, you're still going to pay that Massachusetts tax rate because that's the state where you're earning the money,” Eno explains. The millionaire’s tax isn’t just hurting athletes though.“The CPAs in Boston ... that deal with high-net-worth individuals have said that they have at least one client that's looking to leave. ... The owner of the Boston Celtics is making plans to leave” due to an “estate tax in Massachusetts,” Eno reports. “Is this actually hurting the [Patriot’s] roster?” asks Jill. “I think it’s actually hurting the roster, and I think that all of the teams are seeing this,” says Eno. “Major League Baseball and the [NBA], there’s luxury taxes,” but “in football, you can’t do that.” “[Belichick] is actually making a political statement,” says Blaze Media’s editor in chief Matthew Peterson. To hear more of the conversation, watch the clip above.

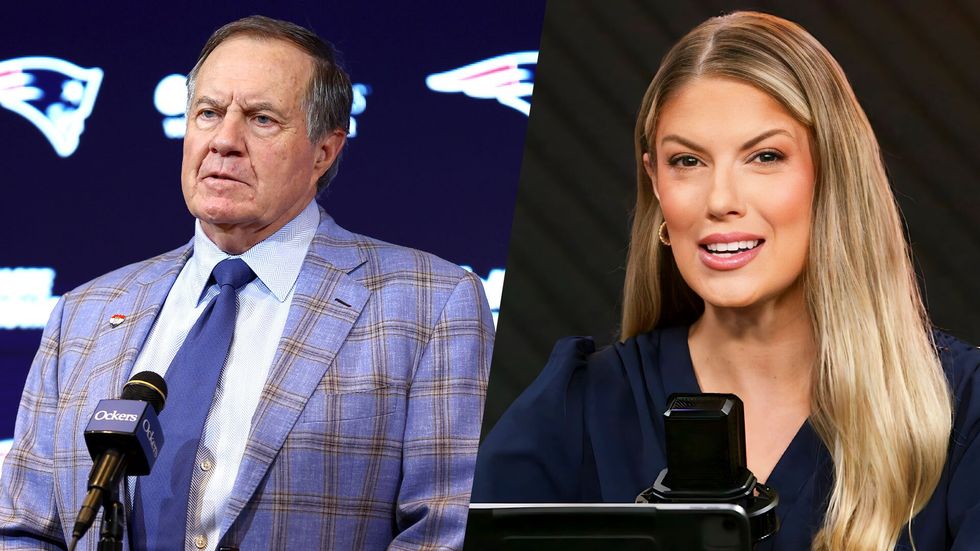

Bill Belichick, former New England Patriots head coach and one of the most decorated coaches in the history of the NFL, is talking taxes.

According to legend, a Massachusetts law is discouraging star football players from signing with the New England Patriots.

“It’s Taxachusetts,” he jested. “Even the minimum players are pretty close to a million dollars, and so once you hit that million-dollar threshold, then you pay more state tax in Massachusetts.”

Rob Eno, BlazeTV Media Critic and a Massachusetts native, joins Jill Savage and the “Blaze News Tonight” panel to explain why athletes may be financially incentivized to sign with teams from states with more sensible tax codes and “why football is affected more than other professional sports.”

- YouTube www.youtube.com

“In November 2022, the citizens of Massachusetts actually voted to get rid of the Constitutional amendment that said they can't have a progressive income tax,” Eno explained, adding that instead, citizens opted to “have a one tax rate flat rate of 5%” as well as “a millionaire surtax of 4%.”

He points to NBA forward Grant Williams as an example of why athletes are flocking away from Massachusetts.

Williams, who played four seasons with the Boston Celtics, compared a Massachusetts’ salary of “$48 million with the millionaire’s tax” to the Dallas, Texas, equivalent of “$54 million.”

“There's this jock tax. ... Even if you live in Dallas, you're going to pay California taxes or Boston taxes for the day games that you do there, but if you live in Massachusetts or if you work for the Boston Celtics or you work for the New England Patriots and you come to Dallas, you're still going to pay that Massachusetts tax rate because that's the state where you're earning the money,” Eno explains.

The millionaire’s tax isn’t just hurting athletes though.

“The CPAs in Boston ... that deal with high-net-worth individuals have said that they have at least one client that's looking to leave. ... The owner of the Boston Celtics is making plans to leave” due to an “estate tax in Massachusetts,” Eno reports.

“Is this actually hurting the [Patriot’s] roster?” asks Jill.

“I think it’s actually hurting the roster, and I think that all of the teams are seeing this,” says Eno. “Major League Baseball and the [NBA], there’s luxury taxes,” but “in football, you can’t do that.”

“[Belichick] is actually making a political statement,” says Blaze Media’s editor in chief Matthew Peterson.

To hear more of the conversation, watch the clip above.

Originally Published at Daily Wire, World Net Daily, or The Blaze

What's Your Reaction?