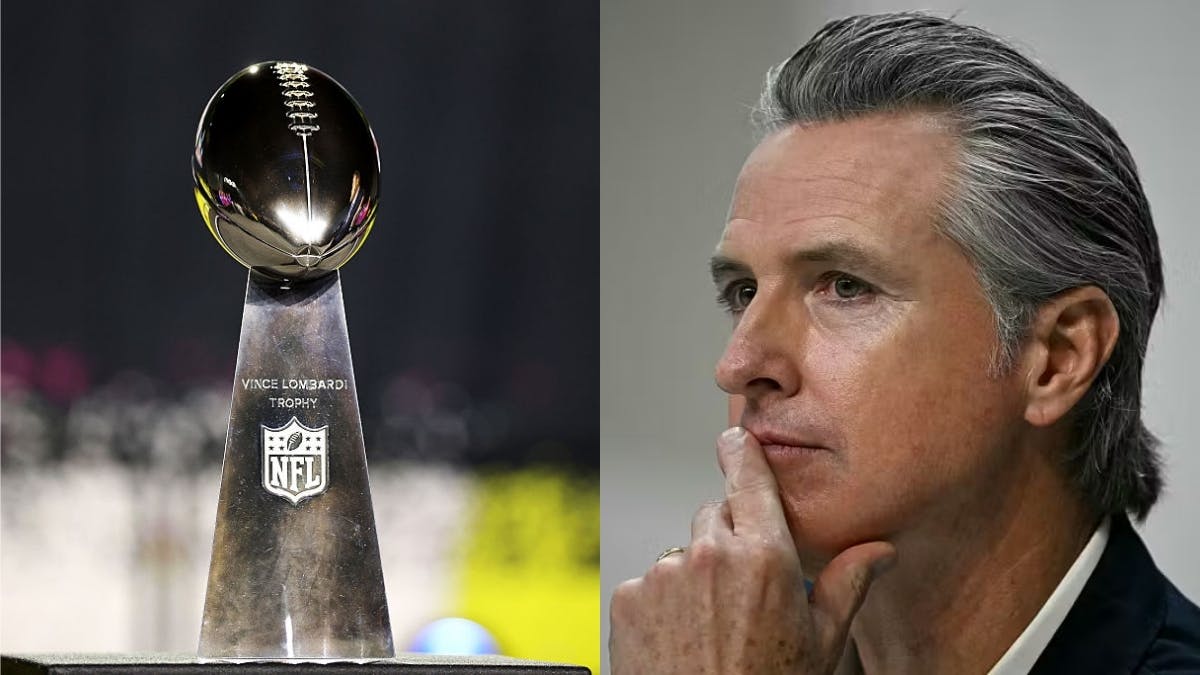

California Taxes Could Cost NFL Stars More Than Their Entire Super Bowl Paychecks

The Super Bowl champion Seattle Seahawks are in for a hefty California tax bill following their 29-13 drubbing of the New England Patriots on Sunday, with some players expected to pay more in taxes than their Super Bowl earnings.

Live Your Best Retirement

Fun • Funds • Fitness • Freedom

Each Seahawks player receives an individual bonus of $178,000 as negotiated by the NFL Players Association, while Patriots players will each receive $108,000.

Both Super Bowl teams are subject to California’s notorious “Jock Tax” imposed on out-of-state professional athletes, which will tax both respective teams on income from the eight “duty days” spent practicing and playing in the Golden State.

Jeffrey Degner, a research fellow in economics at the American Institute for Economic Research, told FOX Business that this tax alone will cut the average player’s Super Bowl bonuses in half at a minimum — without even taking into account additional state and federal taxes.

“What that means here is that the winning team, their take-home pay will be approximately $86,000. If you’re on the losing side, the take-home would be about $49,800,” Degner told FOX Business.

Each “duty day” includes any day spent in California practicing, participating in team meetings, traveling, playing in a game, or doing media events. The state taxes each player by applying the ratio of their duty days in the state to their total duty days overall, then claiming that share of the player’s income.

“The players have a really complex tax situation where they can have 10 or more different states that they’re having to file taxes for,” Degner said. “This is why a lot of these young players, it’s really important for teams to settle them in with sharp financial advisors and tax advisors so that they don’t lose their shirts, so to speak.”

Sport business reporter Kurt Badenhausen estimates that Seahawks quarterback Sam Darnold, with 8+ duty days taxed out of his massive three-year, $105 million deal with Seattle and a $178,000 bonus, will pay $249,000 in California state taxes.

Stanford University Finance Professor and Hoover Institution Fellow Joshua Rauh commented on the numbers, sarcastically complimenting California’s tax system for ensuring the “incentive to win is preserved” by taxing the Super Bowl loser more than the winner.

“If his team wins, Darnold will receive $178k and pay $249k to California in taxes for his time here, losing $71k. If his team loses he gets $103k and still pays over $235k in taxes, losing $135k. I presume California is declaring victory, as his incentive to win is preserved,” Rauh quipped.

California has the highest state income tax rate in the nation, while several states with NFL stadiums — including Tennessee, Texas, and Florida — impose no income tax on their residents or visitors, leading many to question whether future Super Bowls should be held in California.

Originally Published at Daily Wire, Daily Signal, or The Blaze

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0