EXCLUSIVE: Green Energy Investor Arrested In Securities Fraud Probe

Ibrahim AlHusseini, a left-wing venture capitalist who invests in “climate-restoring technologies” and donated more than $300,000 to Democrats, has been arrested on suspicion of securities fraud, The Daily Wire has learned. According to allegations in civil and criminal court papers, he swindled investors in a deal involving $150 million in stock in Aspiration, a progressive banking app and carbon-credits company with the tagline “clean rich is the new filthy rich,” and which has faced probes from the government and others for alleged “greenwashing.”

Investors say they lost $150 million due to the fraud, while AlHusseini transferred $300 million to Saudi Arabia to avoid his debts.

AlHusseini, who was raised in Saudi Arabia by Palestinian parents and says he has raised half a billion dollars in capital, largely for green energy firms, leads the investment firm FullCycle and was a board member of CodePink, which stakes out the U.S. Capitol to harass lawmakers who support Israel and which calls the Gaza war the “US-Israel Holocaust.”

He was arrested on October 7 and jailed until December 21, when federal prosecutors agreed to release him on $3 million bail put up by a who’s-who of wealthy liberal activists and environmentalists, including CodePink’s founder, Jodie Evans.

AlHusseini, whom the government deemed a flight risk, was also required to surrender his Saudi and American passports, turn in his guns, and wear a GPS monitor.

In a previously unreported criminal complaint that said “there is probable cause to believe that AlHusseini has committed securities fraud,” an FBI agent said that the green energy magnate sent investors falsified bank statements that made it seem like he had assets “worth between approximately $80 million to $200 million.”

“In fact, AlHusseini’s brokerage account during this period held between approximately $2,000 and $15,000,” the complaint read.

As a result, an investment firm entered into a deal resulting in “losses in excess of $150 million, including interest and penalties, and AlHusseini personally received more than $12 million in ill-gotten gains,” the criminal complaint said.

AlHusseini’s lawyer, Jessica Nall, told The Daily Wire that he has not been charged with a crime.

The arrest emerged from a civil lawsuit in New York involving Aspiration Inc., a company co-founded by Andrei Cherney, who worked for Bill Clinton and climate hawk Al Gore and ran for Congress last year, and backed by actors Robert Downey Jr. and Leonardo DiCaprio. “Cherny also served as a financial fraud prosecutor alongside Elizabeth Warren on what became the Consumer Financial Protection Bureau,” according to a glowing profile in Forbes.

Cherny said Aspiration aimed to be a bank whose investments aligned with progressive ideology.

“When people move their money out of Chase, or Wells Fargo to Aspiration, they are saying, ‘I don’t want those dollars to fund the Dakota Access Pipeline or a gun manufacturer,’” he told Forbes. AlHusseini—the gun-toting alleged financial fraudster—was an Aspiration investor and board member.

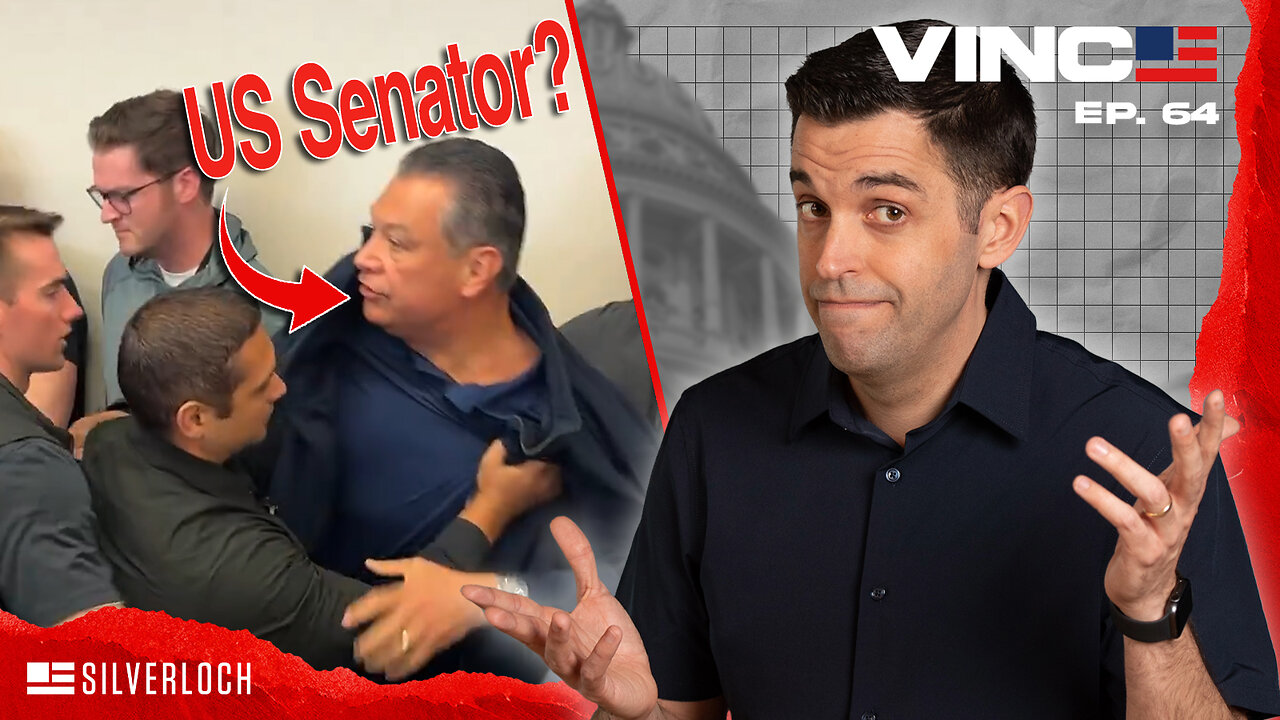

Ibrahim AlHusseini (Photo by Rachel Murray/Getty Images)

Aspiration’s other co-founder was Joe Sanberg, a California progressive activist who takes credit for California expanding a welfare program to illegal immigrants and reportedly considered running for president in 2020.

According to civil and criminal court documents, Sanberg defaulted on a $145 million loan for which AlHusseini had promised to serve as a backstop. An investment firm called Clover Private Credit Opportunities agreed to loan the money to Sanberg–or rather, to an LLC he controlled that in turn owned another LLC called Aspiration Holdings SPE. He put up 10 million shares of Aspiration Partners Inc., the financial services company, as collateral.

Aspiration was not publicly traded, so Clover needed a way to make sure its collateral was liquid. AlHusseini was paid for a “put” option in which he agreed to buy the stock for $65 million in cash if Sanberg defaulted. Clover accepted the promise after receiving documents that said AlHusseini had more than $199 million in accounts that prosecutors say actually held only $2,693, according to court papers.

After there were signs that Sanberg might not be able to pay, AlHusseini agreed to raise the amount to $75 million, the papers say. AlHusseini provided investors with dozens of fraudulent invoices and was paid more than $12 million for making the bailout promises, court papers allege. Prosecutors said Sanberg (who was only called Borrower 1 in criminal documents) sent $5 million of AlHusseini’s cut directly to a relative of his in Saudi Arabia.

Joe Sanberg announces a donation of COVID face masks from himself and Aspiration Inc. (Photo by Presley Ann/Getty Images)

Sanberg defaulted on the loan. Clover took control of the Aspiration stock. But AlHusseini wouldn’t buy it, according to the lawsuit filed by Clover in July 2023 in New York state court. In November 2023, that court entered a judgement against him for $78 million. By then, AlHusseini was acting suspiciously, according to filings by Clover. He fired his lawyer, leaving him unrepresented in the court case, changed his address in court documents to the country of Lebanon, and allegedly took steps to avoid service.

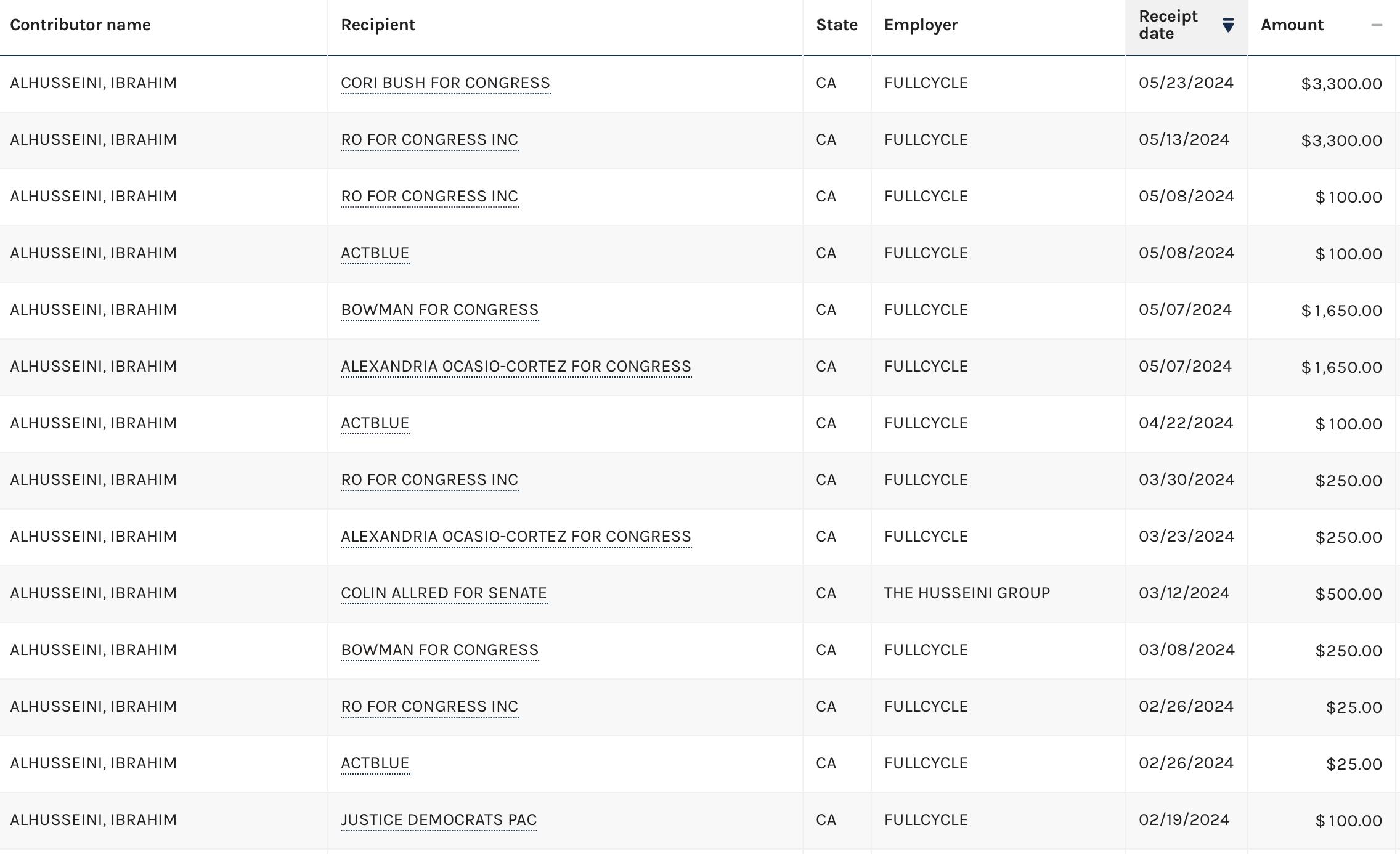

Clover (whose lawyers did not return a request for comment) filed a motion to hold him in contempt of court, noting that even as he failed to pay the judgement, he donated huge sums to politicians, particularly “the squad” of far-left Democrats. His credit card companies turned over records showing he spent money on luxuries such as $750 skin treatments.

Third-party discovery in the lawsuit also likely showed that the financial statements AlHusseini had provided were apparently fake, leading to the criminal probe.

A related lawsuit filed in Los Angeles’s Beverly Hills Courthouse against AlHusseini and his brother, Faisal, said that to avoid paying his debt, he transferred hundreds of millions of dollars to Saudi Arabia, and transferred ownership of his Venice, California mansion to his brother. Lawyers for Faisal tried to escape the lawsuit by saying he had not been physically served, while process servers in Beverly Hills and Saudi Arabia played a cat-and-mouse game.

AlHusseini’s claim that he had essentially no assets remaining in the U.S. suggests that at some point, he liquidated his stake in Aspiration. Aspiration did not return a request for comment asking if he sold his stock, when, and to whom. Sanberg–who countersued Clover in a filing that did not criticize AlHusseini–also did not respond to a Daily Wire inquiry.

Although Sanberg is not accused of wrongdoing, the alleged fraud by AlHusseini, who owned more than five percent of the company, comes as Aspiration has been accused of distorting numbers to increase its profits while falling short of the progressive commitments it uses to lure customers. Bloomberg reported last January that “the Justice Department and Commodity Futures Trading Commission are looking into whether Aspiration misled customers about the quality of carbon offsets it was selling.”

ProPublica reported in 2021 that Aspiration said it had “5 million passionate members” when it actually had half a million active customer accounts, and that it had planted 35 million trees when it had actually planted closer to 12 million. It said Aspiration asked customers to round up their purchases to the nearest dollar to plant a tree, but that not all of that money actually went to planting trees. ProPublica also said that although Aspiration’s selling point was that it avoided supporting fossil fuel companies and other enemies of the left, almost 3% of its portfolio consisted of Southwest Airlines stock.

A Bloomberg investigation in July found “dubious deals that inflated the company’s revenue” as the company sought to go public at a $2 billion valuation. “A nonprofit was supposed to pay Aspiration an amount nearly 10 times greater than its annual revenue. Another client was an unknown LLC created anonymously within days of its deal with Aspiration,” Bloomberg reported. It said another deal appeared to have a Colombian model pay $50,000 a month to Aspiration, and then a company tied to Sanberg would pay her the same amount.

To get AlHusseini out on bail after his arrest, a collection of left-wing activists and green energy magnates put up millions of dollars in real estate and sureties. Jodie Evans, a Democrat activist who founded Code Pink and once managed the campaign of former California Gov. Jerry Brown, put up her $3.3 million Venice home, which has a sign in the window that says “Free Free Palestine.” Evans did not return a request for comment, but CodePink no longer lists AlHusseini as a board member on its website.

Lekha Singh, a feminist artist who co-produced a documentary about the Egyptian revolution with AlHussein and Evans, put up her Texas farm.

Julie Preger, co-founder of eVolutionary Green Holdings, “focusing on the environmentally sustainable products,” put up her $1.6 million home in Colorado. Melony Lewis, a trustee of the liberal Aspen Institute and cofounder of Canyon Echo Capital, put up an LLC worth $6 million.

Rostam Zafari, the “CEO of World Within, a nonprofit that funds organizations building wealth for marginalized communities,” also contributed, as did Kamal el-Watter, founder of a company whose “Indigenous Data Warriors program envisions a future where all indigenous communities have ‘data sovereignty’ … when their knowledge is used in AI tools … monetary compensation will flow smoothly to those who have stewarded knowledge for millennia.”

Originally Published at Daily Wire, Daily Signal, or The Blaze

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0