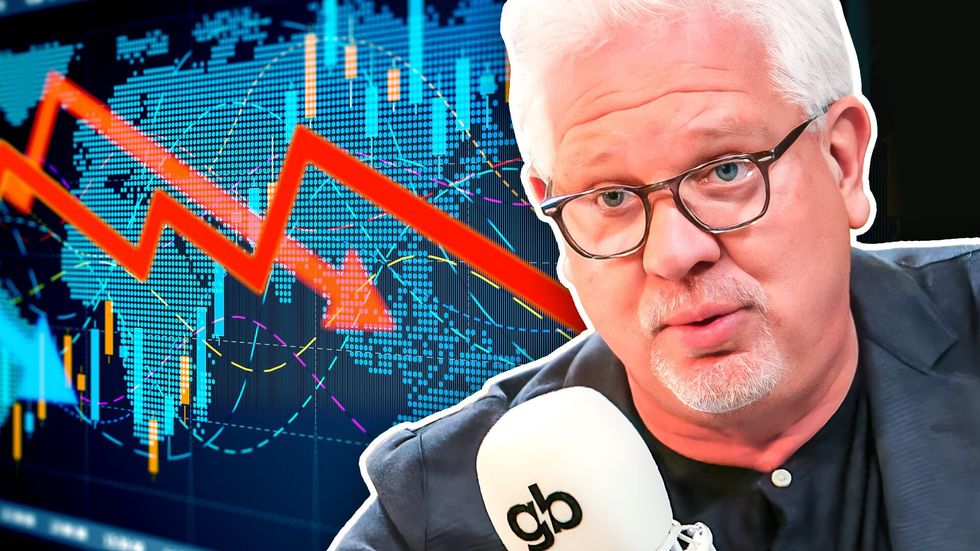

Explained: Why the Fed lowering interest rates might be a BAD sign ...

When Glenn Beck first heard the news that the Federal Reserve lowered the interest rate by half a point, which is the first time it’s been lowered since 2020, his first thought was “this is election interference by the Fed.” His second thought was that the last time the Fed did this, it didn’t lead to a positive outcome. Recovering investment banker Carol Roth joins the show to break down the details. “What’s really going on here, Carol?” Glenn asks. “First of all, Glenn, I just want you to know that I am unburdened by what has been, and now the market is in terms of interest rates because we are in a rate-cutting environment,” says Roth, taking a jab at Kamala Harris. “I think the important thing to remember is that when we talk about rate heights, rate cuts — anything the Fed’s doing — we have to keep it in context, and the backdrop is that we came out of 15 years of what's called ZIRP — zero interest rate policy — where the interest rates were at or near zero,” she continues, adding that in addition, the Fed put “$9 trillion plus on its balance sheet.” According to Roth, there’s the potential for both good and bad with this lowered interest rate. Starting with the potential bad, Roth says, “when you are saying that the economy is doing amazing” and then follow with “a very large cut,” it can “send a signal to say things are not going so well.” However, “after 15 years of zero interest rate policy, it does make sense for us to get back to what's considered a neutral rate,” she says. “Is this an inflationary move?” asks Glenn. “So that’s the question,” says Roth. “If you think about what the neutral rate is, which is theoretical — we don't know the number — but basically it's the dividing line between policy that is restrictive and policy that is accommodative, and what we're trying to do is have the Fed have no influence in either direction. I believe that we are still in that restrictive area.” “I don’t think that will cause inflation,” she says. “I wouldn't be spending a dime right now on hiring, building — anything. Not a dime until I see what happens at the election,” says Glenn, adding that if Harris gets elected, he’s “battening down the hatches,” but if Trump wins, he’d be “willing to invest.” To hear Roth’s thoughts, watch the clip above. Want more from Glenn Beck?To enjoy more of Glenn’s masterful storytelling, thought-provoking analysis, and uncanny ability to make sense of the chaos, subscribe to BlazeTV — the largest multi-platform network of voices who love America, defend the Constitution, and live the American dream.

When Glenn Beck first heard the news that the Federal Reserve lowered the interest rate by half a point, which is the first time it’s been lowered since 2020, his first thought was “this is election interference by the Fed.”

His second thought was that the last time the Fed did this, it didn’t lead to a positive outcome.

Recovering investment banker Carol Roth joins the show to break down the details.

“What’s really going on here, Carol?” Glenn asks.

“First of all, Glenn, I just want you to know that I am unburdened by what has been, and now the market is in terms of interest rates because we are in a rate-cutting environment,” says Roth, taking a jab at Kamala Harris.

“I think the important thing to remember is that when we talk about rate heights, rate cuts — anything the Fed’s doing — we have to keep it in context, and the backdrop is that we came out of 15 years of what's called ZIRP — zero interest rate policy — where the interest rates were at or near zero,” she continues, adding that in addition, the Fed put “$9 trillion plus on its balance sheet.”

According to Roth, there’s the potential for both good and bad with this lowered interest rate.

Starting with the potential bad, Roth says, “when you are saying that the economy is doing amazing” and then follow with “a very large cut,” it can “send a signal to say things are not going so well.”

However, “after 15 years of zero interest rate policy, it does make sense for us to get back to what's considered a neutral rate,” she says.

“Is this an inflationary move?” asks Glenn.

“So that’s the question,” says Roth. “If you think about what the neutral rate is, which is theoretical — we don't know the number — but basically it's the dividing line between policy that is restrictive and policy that is accommodative, and what we're trying to do is have the Fed have no influence in either direction. I believe that we are still in that restrictive area.”

“I don’t think that will cause inflation,” she says.

“I wouldn't be spending a dime right now on hiring, building — anything. Not a dime until I see what happens at the election,” says Glenn, adding that if Harris gets elected, he’s “battening down the hatches,” but if Trump wins, he’d be “willing to invest.”

To hear Roth’s thoughts, watch the clip above.

Want more from Glenn Beck?

To enjoy more of Glenn’s masterful storytelling, thought-provoking analysis, and uncanny ability to make sense of the chaos, subscribe to BlazeTV — the largest multi-platform network of voices who love America, defend the Constitution, and live the American dream.

Originally Published at Daily Wire, World Net Daily, or The Blaze

What's Your Reaction?