'Lipstick on a pig': How printing cash is destroying America — and crypto could be next

Decisions made in the 1970s may still be affecting the average American's ability to buy a home.

Live Your Best Retirement

Fun • Funds • Fitness • Freedom

When the United States used gold as a standard for backing its currency, it acted as a limiter on money creation, capping the amount of currency that could be printed.

'You have one year. One year. I don't give a damn. I don't care if you go bankrupt.'

According to currency expert and author Paul Stone, severing the U.S. dollar from gold in 1971 allowed for unlimited money-printing, immediately devaluing Americans' savings while causing the unfettered spiraling of housing prices.

"The best way for everyone to understand gold standard ... is it's just a limiter," Stone told Return in an interview. "They raised gold's price to 35 bucks an ounce, which immediately diluted your savings by 40%. ... That's evil. When the government fixes its problems or addresses them at our expense, that's evil."

Likening uncontrolled money-printing to making "cotton candy out of thin air," Stone told Return that the government has continuously doubled down on creating a false financial-energy system that causes stress and burden where it need not be.

Nowhere is this more apparent than in housing costs.

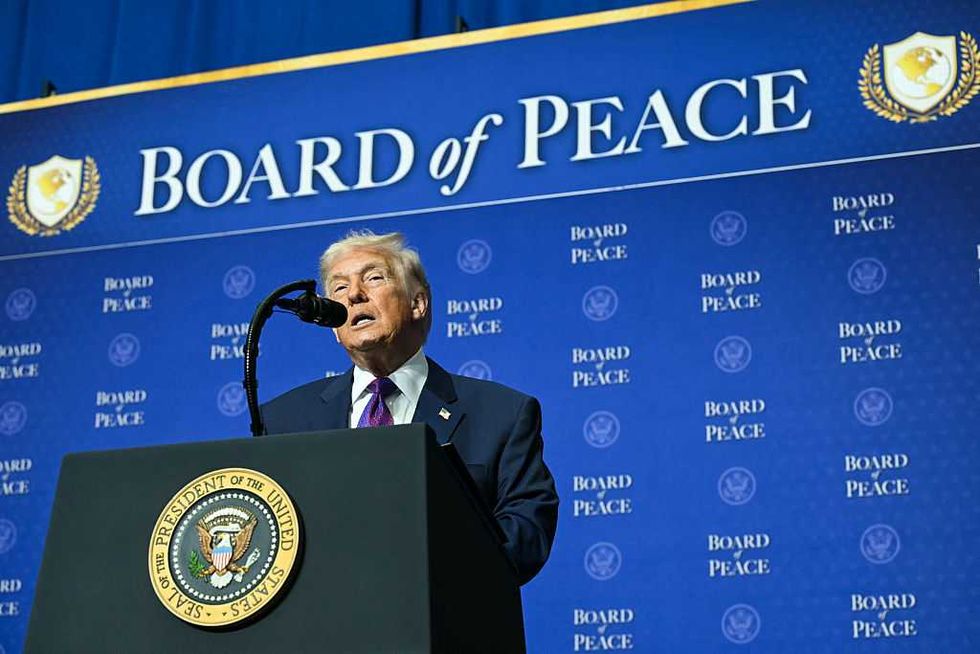

RELATED: Jerome Powell proves the Fed’s ‘independence’ is a myth

Alex Wroblewski/Bloomberg via Getty Images

Alex Wroblewski/Bloomberg via Getty Images

Contrasting the median price of a home in 1970 ($23,000), Stone said today's average of $420,000 should be around $56,000-$70,000 if it were not for inflation caused by money printing.

Printing "us" out of debt was continuously perpetuated, Stone explained, all the way through the Bill Clinton administration, which "made fractional lending happen."

Stone explained that with fractional lending, banks were allowed to lend 10 times the real amount of their money, which flooded the market with nonexistent capital. With that much money floating around, and an additional 1,000% spending power, the money directly inflated real estate pricing.

"So the price goes from what we think it ought to be ... to $420,000 grand?!" he laughed, disappointedly.

When Stone was asked whether or not cryptocurrency, or perhaps specifically Bitcoin, was a way to circumvent inflation and make real capital gains, Stone identified that the method of currency is not the problem, but rather it is the user.

RELATED: I went to El Salvador to see if the country really gave up on Bitcoin

"The reason there's a ton of crypto is we're brilliant creations," Stone theorized. "And so people started to sense issues with government money. So they created non-government money. And of course the government has the power to get on top of that. And now it's all just lipstick on a pig."

The currency, whether crypto or fiat, will continue to be devalued and spiral out of control if the government does not change its core thesis, the author continued. "You can rename the dollar to some other name and it's still worth three cents and you're still printing money to pay your bills and you're still killing the currency. There's no way out of this."

His radical solution? "Stop printing a dollar. Literally start back and just bring reality in as it kicks our ass," Stone bluntly stated.

Additionally, Stone said that his "drastic" solution would include telling all U.S. corporations that they have one year to stop manufacturing outside of the country.

"You have one year. One year. I don't give a damn. I don't care if you go bankrupt. The country is practically dead financially."

At the same time, he suggested a focus on state power and urged young Americans to vote with their feet and attempt to create an insulated environment in an affordable place. This sort of devolution revolution involves citizens not paying for what the federal government could not pay for if it weren't for money-printing.

Stone urged, "The number-one solution to all this is you either move to a place where what you earn overwhelms your bills better or the government stops printing. ... Move to a small town."

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

Originally Published at Daily Wire, Daily Signal, or The Blaze

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0