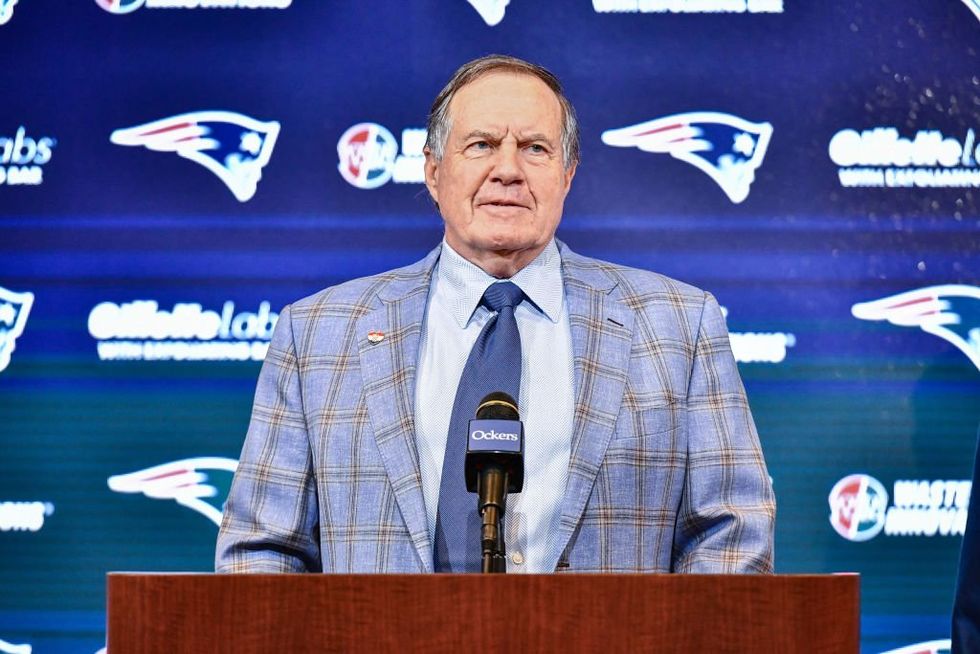

'That's Taxachusetts': Coach Bill Belichick says Massachusetts' millionaire tax makes it harder to negotiate contracts

Legendary NFL head coach Bill Belichick commented on how nearly all NFL players who come to the New England Patriots are hit with a "millionaire's tax" that significantly cuts into their incomes.The eight-time Super Bowl winning coach was discussing factors that play into what team high-profile NFL players choose to play for. Specifically, Belichick was discussing Dallas Cowboys wide receiver CeeDee Lamb.Lamb recently signed a four-year, $136 million contract extension with the Dallas Cowboys, who of course play in Texas where there is no state income tax. Belichick mentioned this factor while on the "Pat McAfee Show."'It's not like Tennessee or Florida or Nevada. Some of these teams have no state income tax.'In reference to rumors that Lamb was considering going to San Francisco, Belichick said, "Does [Lamb] want as much money as possible? Yeah, of course. But is it really worth it to go out of town to wherever and not be playing in the environment and the opportunity he has there in Dallas?""If you're already on that team, then how much is it really worth by the time you move, pay your 50% tax, or your millionaire's tax in New England?" the coach asked."What's that millionaire's tax about, coach?" the hosts asked at the same time."That's Taxachusetts," Belichick replied. "Virtually every player, even the practice squad, even the minimum players are pretty close to $1 million. Once you hit the $1 million threshold, then you pay more state tax in Massachusetts," he explained. Belichick added that the taxation levels have become a bargaining chip for players' agents, who often demand more money due to the Massachussetts state tax levels."Just another thing you've got to contend with in negotiations up there. It's not like Tennessee or Florida or Nevada. Some of these teams have no state income tax. You get hit pretty hard on that with the agents."Host McAfee, who played in Indiana where there is a state income tax rate of just over 3%, joked about "destination" cities where teams have an advantage when it comes to negotiating contracts."That was why, when these destination teams start popping up ... it's like if you're in Florida or Texas or Tennessee it's all of a sudden really good. That's good bartering, that's a couple hundred thousand. That's a lot of — hey! That's a lot of money here! Now, we all want to pay our fair share; where's it going, I would like to learn that, but we all want to pay ... all right we'll stay away from that," he joked.Wide receiver Calvin Ridley recently signed with the Tennessee Titans over the New England Patriots, with Patriots owner Robert Kraft stating that the tax rates between the two states was one of Ridley's deciding factors, NESN reported.Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

Legendary NFL head coach Bill Belichick commented on how nearly all NFL players who come to the New England Patriots are hit with a "millionaire's tax" that significantly cuts into their incomes.

The eight-time Super Bowl winning coach was discussing factors that play into what team high-profile NFL players choose to play for. Specifically, Belichick was discussing Dallas Cowboys wide receiver CeeDee Lamb.

Lamb recently signed a four-year, $136 million contract extension with the Dallas Cowboys, who of course play in Texas where there is no state income tax. Belichick mentioned this factor while on the "Pat McAfee Show."

'It's not like Tennessee or Florida or Nevada. Some of these teams have no state income tax.'

In reference to rumors that Lamb was considering going to San Francisco, Belichick said, "Does [Lamb] want as much money as possible? Yeah, of course. But is it really worth it to go out of town to wherever and not be playing in the environment and the opportunity he has there in Dallas?"

"If you're already on that team, then how much is it really worth by the time you move, pay your 50% tax, or your millionaire's tax in New England?" the coach asked.

"What's that millionaire's tax about, coach?" the hosts asked at the same time.

"That's Taxachusetts," Belichick replied. "Virtually every player, even the practice squad, even the minimum players are pretty close to $1 million. Once you hit the $1 million threshold, then you pay more state tax in Massachusetts," he explained.

Belichick added that the taxation levels have become a bargaining chip for players' agents, who often demand more money due to the Massachussetts state tax levels.

"Just another thing you've got to contend with in negotiations up there. It's not like Tennessee or Florida or Nevada. Some of these teams have no state income tax. You get hit pretty hard on that with the agents."

Host McAfee, who played in Indiana where there is a state income tax rate of just over 3%, joked about "destination" cities where teams have an advantage when it comes to negotiating contracts.

"That was why, when these destination teams start popping up ... it's like if you're in Florida or Texas or Tennessee it's all of a sudden really good. That's good bartering, that's a couple hundred thousand. That's a lot of — hey! That's a lot of money here! Now, we all want to pay our fair share; where's it going, I would like to learn that, but we all want to pay ... all right we'll stay away from that," he joked.

Wide receiver Calvin Ridley recently signed with the Tennessee Titans over the New England Patriots, with Patriots owner Robert Kraft stating that the tax rates between the two states was one of Ridley's deciding factors, NESN reported.

Like Blaze News? Bypass the censors, sign up for our newsletters, and get stories like this direct to your inbox. Sign up here!

Originally Published at Daily Wire, World Net Daily, or The Blaze

What's Your Reaction?