The Secret Weapon That Will Supercharge ‘Trump Accounts’ For Newborns

There’s a secret weapon tucked inside “Trump Accounts” that gives each member of the coming generation the chance to have a six-figure investment account by the time they’re 18.

Live Your Best Retirement

Fun • Funds • Fitness • Freedom

Not only will every American child born between January 1, 2025, and December 31, 2028 receive an account loaded with $1,000, courtesy of President Donald Trump, congressional Republicans, and the One Big Beautiful Bill Act. But parents and their employers will be able to make contributions that would supercharge its growth. This month, the Treasury Department pulled back the curtain on how Trump Accounts are designed to work.

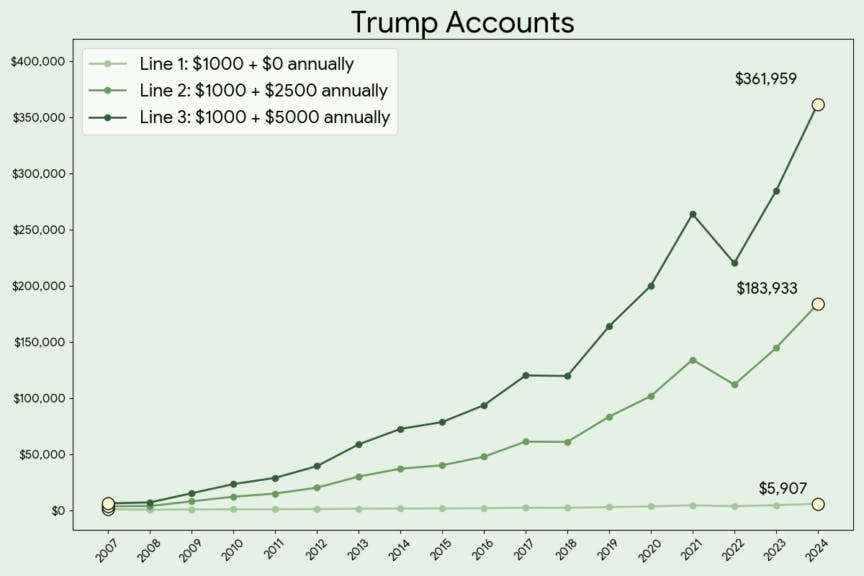

With the rules now clear, The Daily Wire crunched the numbers to find out what an 18-year-old would have today if they’d received a Trump Account when they were born in 2007.

If left untouched, the accounts would be worth nearly six times as much, the financial analysis found, leaving each child to enter adulthood with $5,907. With supplemental investments, however, they’d be set with accounts well into the six figures.

To encourage participation, the Trump administration made employer contributions tax-exempt. If a parent’s employer added $2,500 to the account each year, half the allowed contribution, that account would be worth $183,933. And most dramatically, a child whose Trump Account received the maximum $5,000 per year would be sitting on $361,959 today.

The analysis showcases how the administration empowers the next generation to unlock compound investing, a financial concept that Albert Einstein once called the eighth wonder of the world. Compound investing is like a snowball rolling down a hill. The $1,000 deposit is the snowball, and as it grows, the returns start adding their own “snow,” making the ball bigger and bigger over time. The money isn’t just sitting there, it’s actively making more money, and that money makes even more money.

There is rising concern about the financial prospects for young Americans as costs rise in the country. During the Biden administration, costs of goods increased by roughly 20% over four years. The Trump administration has vowed to tackle affordability issues, and these accounts are part of that strategy, with a top Trump official saying the accounts give each kid “a piece of the American economy.”

“It is a trust fund, a piece of the American economy for every child that they will be able to take out when they are 18, or they could convert it to a more IRA-type program,”explained Trump’s Treasury Secretary Scott Bessent.

The Trump administration says the accounts will be professionally invested in a low-cost index fund that tracks the overall United States stock market. Once the child turns 18, they will have the option to transition the account into a traditional IRA, setting themselves up with financial stability before they even enter the workforce.

The Daily Wire simulated the portfolio assuming the investments were made in the S&P 500, which is an index of the 500 largest companies in America. Historically, investments in the S&P 500 have earned dividends, regular cash payments from companies’ profits. The Daily Wire treated this portfolio as if those dividends would be reinvested, allowing the investment to grow over time through both stock price gains and compounding dividend income.

If Trump Accounts had existed for the past 65 years, and a child received the same annual $5,000 contributions from 1959 to 2024, the account invested in the S&P 500 would have grown to nearly $45 million. Left untouched, the $1,000 deposit would have compounded to $721,614 over that period.

But the path wouldn’t have always been smooth. In 2008 alone, when the economy crashed, the portfolio would have dropped 37%, falling from roughly $8 million to $5 million in a single year, before taking about five years to fully recover. Yet the long arc would still have been overwhelmingly positive, in the sixteen years since the recession, the S&P 500 has posted gains in 14 of them with only two down years. World renowned investor Warren Buffett says, “Despite some severe interruptions, our country’s economic progress has been breathtaking. Our unwavering conclusion: Never bet against America.”

The idea behind Trump Accounts originated with Altimeter Capital CEO Brad Gerstner, who has been talking about the policy for years.

“How about we give a $2,000 stipend at birth that people cannot withdraw that compounds the future of America,” Gerstner said in 2021. “I would love to see a national savings account in this country where everybody gets to participate in the value creation.”

Gerstner first pitched the concept to the Biden administration, but it never materialized. Under Trump, the concept was folded into the One Big Beautiful Bill.

Speaking from the Oval Office earlier this month, President Trump announced that billionaire Michael Dell will contribute $6.25 billion to accelerate the rollout. Dell’s funding will support children ages 10 and under who do not qualify for the one-time Treasury Department deposit. The funds will be available to children within ZIP codes where the median household income is under $150,000, a move Gerstner predicted back in May. “I suspect that philanthropists may contribute more to the Invest America accounts of kids whose parents earn less,” Gerstner said.

Bessent added that the Treasury Department is already in discussions with many philanthropists and foundations about additional contributions. More details on how families can open these accounts are expected in the coming weeks, ahead of the program’s official launch on July 5, 2026.

Originally Published at Daily Wire, Daily Signal, or The Blaze

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0