Trump Vows To Lower Mortgages With ‘$200 Billion’ Bond Purchase

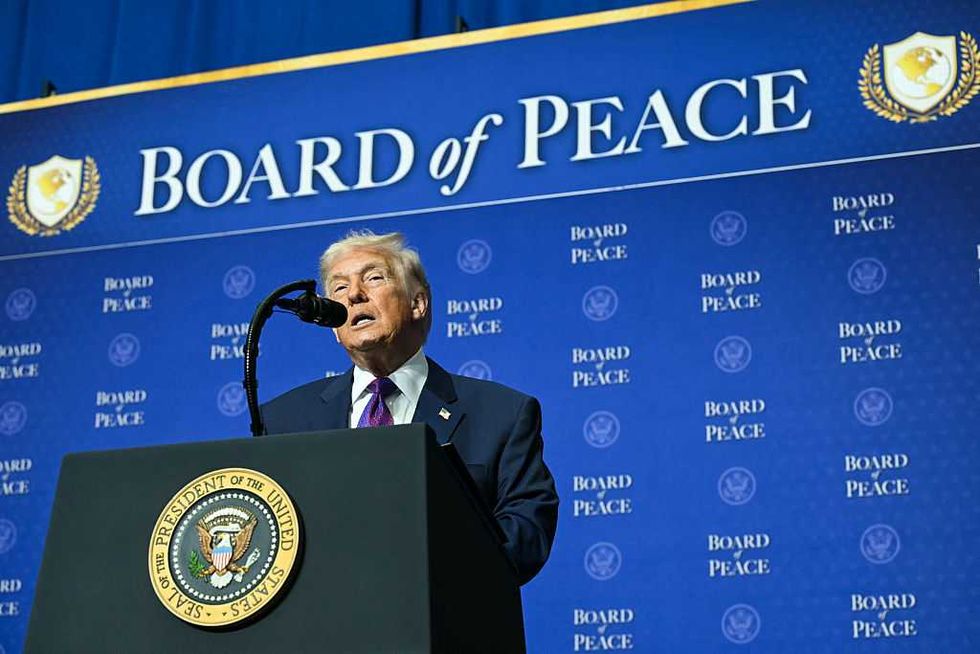

President Donald Trump announced that the federal government will purchase $200 billion in mortgage bonds in an effort he believes will help lower housing costs.

Live Your Best Retirement

Fun • Funds • Fitness • Freedom

In a Truth Social post on Thursday, he said former President Joe Biden “ignored the housing market” and said that he, by contrast, is giving “special attention” to the issue.

“Because I chose not to sell Fannie Mae and Freddie Mac in my First Term, a truly great decision, and against the advice of the ‘experts,’ it is now worth many times that amount — AN ABSOLUTE FORTUNE — and has $200 BILLION DOLLARS IN CASH,” he said.

“Because of this, I am instructing my Representatives to BUY $200 BILLION DOLLARS IN MORTGAGE BONDS. This will drive Mortgage Rates DOWN, monthly payments DOWN, and make the cost of owning a home more affordable,” the president continued. Trump directly said it would help in “restoring Affordability,” which has become a buzzword on the 2026 campaign trail as the country still recovers from post-pandemic and Biden-era inflation.

The announcement comes after he said on Wednesday that he would be taking action against institutional investors purchasing single-family homes.

“It is for that reason, and much more, that I am immediately taking steps to ban large institutional investors from buying more single-family homes, and I will be calling on Congress to codify it. People live in homes, not corporations. I will discuss this topic, including further Housing and Affordability proposals, and more, at my speech in Davos in two weeks,” Trump wrote on Wednesday.

The Daily Wire reported after Trump’s Wednesday announcement, this is part of a larger effort by the administration to tackle housing woes nationwide, including the push from the president to select a Federal Reserve chair who will aggressively cut interest rates, as Chair Jerome Powell leaves the role in May.

“Could somebody please inform Jerome ‘Too Late’ Powell that he is hurting the Housing Industry, very badly? People can’t get a Mortgage because of him. There is no Inflation, and every sign is pointing to a major Rate Cut,” the president posted to Truth Social in August.

Home prices have surged over the last decade by 105%, according to MoneyLion in October.

Originally Published at Daily Wire, Daily Signal, or The Blaze

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0