U.S. defense faces new trouble as China restricts export of minerals used in weapons

'Even though we haven't expressed as much interest in mining in the United States as we have in years past, I think that has to change'

The U.S. defense sector could see a rise in costs because China has implemented new export restrictions on an important mineral used in military equipment.

According to Fox News, six antimony-related products, including antimony oxide, antimony ore and antimony metal, are subject to export limits by China as of Sunday. Antimony is used in ammunition, infrared missiles, nuclear weapons, batteries, photovoltaic equipment, night vision goggles, and as a flame-retardant component in machine bearings.

China produced almost half of the world’s supply of antimony in 2023, while the U.S. imported approximately 63% of its antimony metal and ore from China – consuming around 22,000 tons. China is also the leading import source for 25 essential minerals – tungsten, germanium, magnesium, barite, antimony, most rare earths, indium, graphite, gallium, and arsenic.

The Financial Times reported the shift to green energy has increased the demand for antimony, and is a critical part of supply chains, particularly in defense. Because of this, antimony prices have hit more than $25,000 per ton in Europe and China – doubling over the past year alone.

According to Gary Evans, co-CEO and board member of US Antimony Corporation, the U.S. is in a position to fill the gap with its own supply of antimony for the time being, but some full supplies may still be years from being available.

“There is a company that the government has helped fund called Perpetua Resources, which has received over $50 million [in] grants. There is also a gold mine in Idaho that has a lot of antimony associated with it. So that supply [will] be available, but it may be [several] years away,” Evans said.

Evans noted the U.S. is planning to secure its antimony supply chain by exploring new opportunities, and revisiting existing mines that were closed decades ago.

“We have a mine in Thompson Falls, Montana, which is near adjacent to our smelter. It was shut down in 1983. We’re combing our records to determine whether it makes sense to open that mine back up. At the request of the Department of Defense, we have a laundry list of ideas, which includes new mining opportunities we have in Canada and Alaska, as well as opening [of] the Thompson Falls mine,” Evans said.

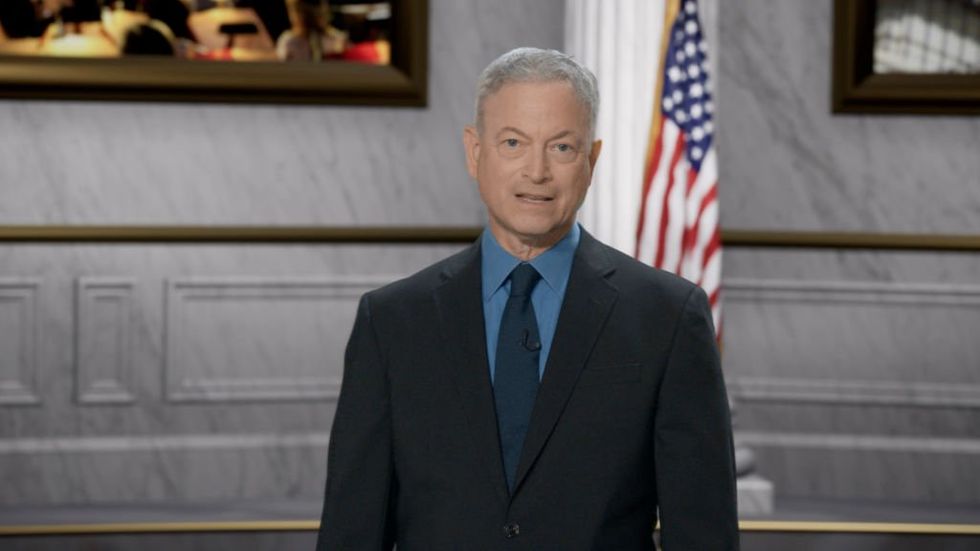

U.S. Rep. Rob Wittman, R-Va., a member of the Select Committee on the Chinese Communist Party, said the U.S. needs to build a strong mining labor force if it hopes to compete with China.

“Even though we haven’t expressed as much interest in mining in the United States as we have in years past, I think that has to change,” Wittman said.

.@RobWittman speaks on the importance of creating a strong American critical mineral workforce.

“Even though we haven’t expressed as much interest in mining in the United States in years past, I think that has to change.” pic.twitter.com/LYDrmp9FFX

— Select Committee on the Chinese Communist Party (@committeeonccp) September 12, 2024

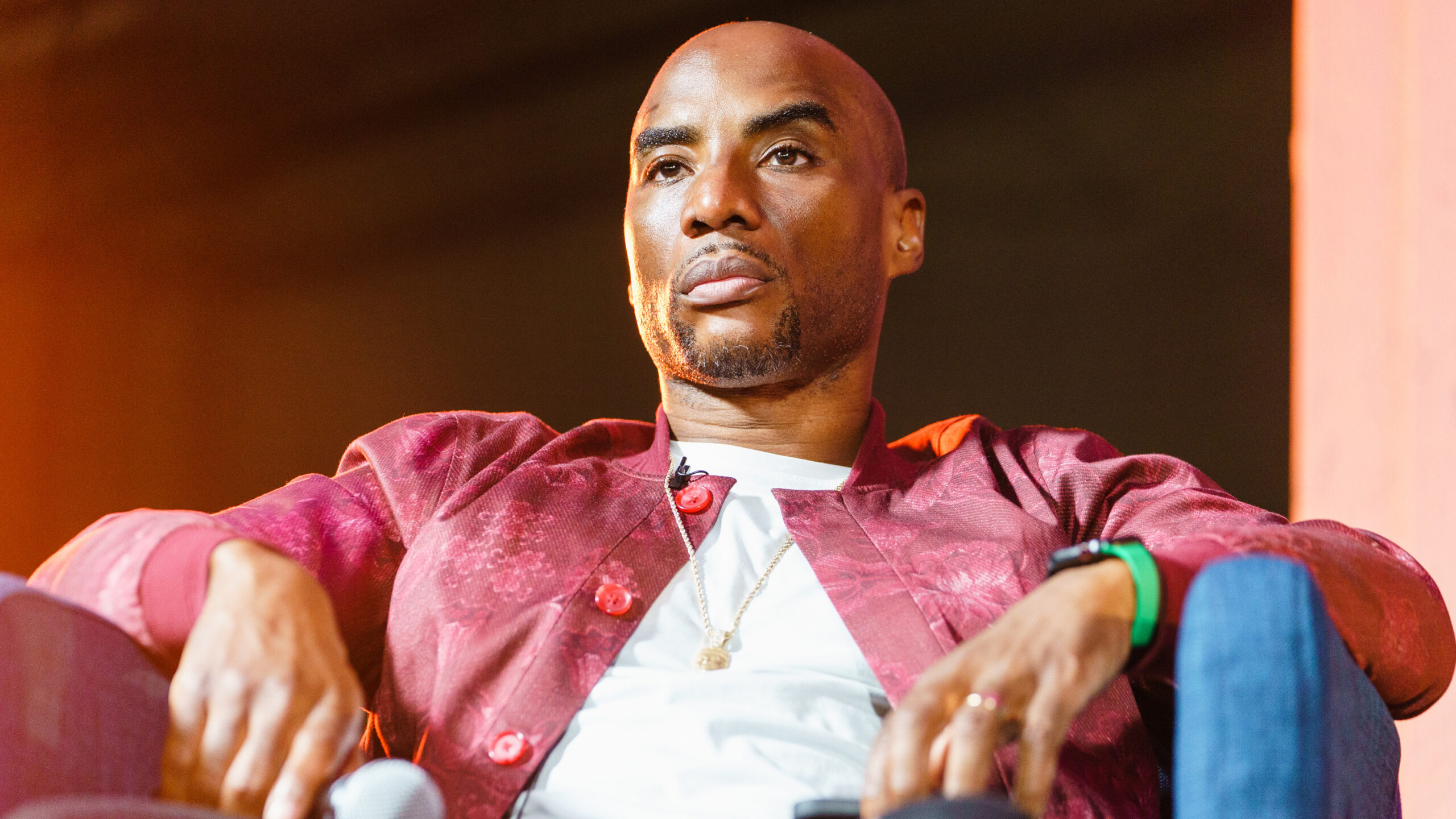

U.S. Rep. Kathy Castor, R-Fla., reiterated Wittman’s comments, and stated the mining workforce is going to shrink by half by 2029.

“More than half the current domestic mining workforce will be retired or replaced by 2029. That number stands in stark contrast to a total of just 327 degrees awarded in 2020 in mining and mineral engineering, and a 39% net drop in graduations in the U.S. since 2016,” Castor said.

“More than half the domestic mining workforce will be retired or replaced by 2029.

That number stands in stark contrast to the total of just 327 degrees awarded in 2020 in mining and mineral engineering.” — @USRepKCastor pic.twitter.com/SnpE6CA2bk

— Select Committee on the Chinese Communist Party (@committeeonccp) September 12, 2024

The restrictions on antimony come after the Biden-Harris administration increased tariffs on China in recent months, ranging from 100% on electric vehicles, to 50% on solar cells, and 25% on aluminum and steel products.

According to a statement from the White House, the tariffs were a countermeasure to China’s unfair trade practices.

“China’s unfair trade practices concerning technology transfer, intellectual property, and innovation are threatening American businesses and workers. China is also flooding global markets with artificially low-priced exports. In response to China’s unfair trade practices and to counteract the resulting harms, today, President Biden is directing his Trade Representative to increase tariffs under Section 301 of the Trade Act of 1974 on $18 billion of imports from China to protect American workers and businesses.”

However, China has called the tariffs imposed by the U.S. unfair, and has the backing of the World Trade Organization who has determined the Section 301 tariffs violate WTO rules.

#China is strongly dissatisfied with and firmly opposes #US abuse of Section 301 to hike tariffs on some Chinese goods, the Ministry of Commerce said Saturday.https://t.co/C5WFzv2MxB

— China Daily Hong Kong (@CDHKedition) September 15, 2024

Chinese Ministry of Commerce spokesperson He Yongqian called the increase on tariffs wrong, and urged the U.S. to “correct its mistakes,” after the Office of the United States Trade Representative allegedly delayed its determinations for Section 301 tariffs on Chinese products.

“China has lodged solemn representations to the US side on Section 301 tariffs for many times. The World Trade Organization (WTO) has long ruled that the U.S. Section 301 tariffs violate WTO rules, and it is even more wrong for the U.S. to increase tariffs on China. The Office of the USTR previously sought public comments regarding its tariffs review results, and most opinions were against imposing tariffs or applying for an expansion of tariff exemption, which demonstrates that the practice of the U.S. is not well-received. We urge the U.S. to correct its mistakes, actively respond to public calls, and remove all the tariffs on China,” He Yongqian said.

Originally Published at Daily Wire, World Net Daily, or The Blaze

What's Your Reaction?