Why state mileage taxes violate your constitutional rights

Does your state charge you for every mile you drive? Oregon's been doing it since 2015. Utah since 2020. And more states are planning to follow suit. There's just one problem: So-called mileage taxes are blatantly unconstitutional. The right to travel freely is a fundamental right; as such, it is protected under the Privileges and Immunities Clause of Article IV and the Due Process Clause of the 14th Amendment. The $1.2 trillion "Bipartisan Infrastructure Deal" Sec. 13002 contains provisions that implement a federal per-mile user fee on drivers of passenger vehicles and requires carmakers to build driver monitoring technology. How will the government check your mileage? Look no farther than your smartphone, which knows where you are and how fast you're going. Oh, and it listens to what you're saying, too. Leave it to California Governor Gavin Newsom (D) to take such an Orwellian idea and run with it. He wants to install special GPS odometers in both gas and electric cars (as well as motorcycles) in order to charge Californians three cents for each mile driven. Don't worry, these new tracking devices will stop charging you the minute you leave the state — honest! Newsom claims the new by-the-mile system will let the state get rid of its gasoline tax — but don't hold your breath. At any rate, this mileage tax shouldn't be on the table at all — in any state. In its 1868 decision Crandall v. State of Nevada, the Supreme Court ruled that states cannot impose taxes or regulations that burden the right of individuals to travel freely, including the modes of travel they use. The case specifically addressed Nevada's attempt to tax individuals leaving the state by various means of conveyance, such as stagecoaches or steamboats. The right to travel freely is a fundamental right; as such, it is protected under the Privileges and Immunities Clause of Article IV and the Due Process Clause of the 14th Amendment. The Court's reasoning was grounded in the principle that such taxes would infringe upon a fundamental right and exceed the permissible scope of state taxation powers. Since all citizens have the right to move around freely, a state cannot impose taxes that interfere with their ability to leave. The bottom line is the government does not have the right to charge you by the mile, no matter what these legislators may think. But legal niceties are of little interest to budding authoritarians looking for more cash from their subjects. Now is the time to fight back against these laws before our rights as drivers — and as citizens — are eroded any further.

Does your state charge you for every mile you drive?

Oregon's been doing it since 2015. Utah since 2020. And more states are planning to follow suit.

There's just one problem: So-called mileage taxes are blatantly unconstitutional.

The right to travel freely is a fundamental right; as such, it is protected under the Privileges and Immunities Clause of Article IV and the Due Process Clause of the 14th Amendment.

The $1.2 trillion "Bipartisan Infrastructure Deal" Sec. 13002 contains provisions that implement a federal per-mile user fee on drivers of passenger vehicles and requires carmakers to build driver monitoring technology.

How will the government check your mileage? Look no farther than your smartphone, which knows where you are and how fast you're going. Oh, and it listens to what you're saying, too.

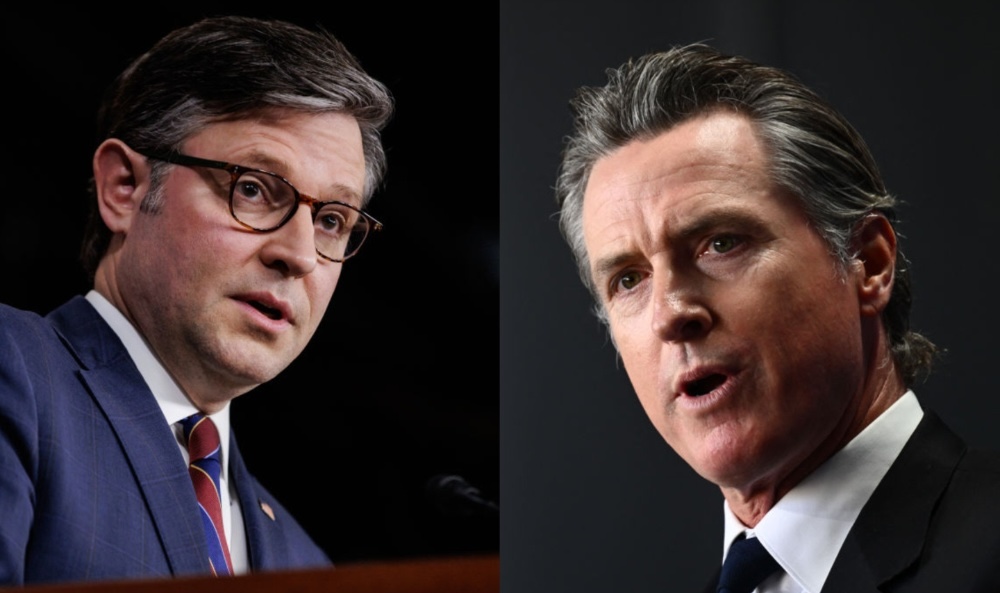

Leave it to California Governor Gavin Newsom (D) to take such an Orwellian idea and run with it. He wants to install special GPS odometers in both gas and electric cars (as well as motorcycles) in order to charge Californians three cents for each mile driven.

Don't worry, these new tracking devices will stop charging you the minute you leave the state — honest!

Newsom claims the new by-the-mile system will let the state get rid of its gasoline tax — but don't hold your breath. At any rate, this mileage tax shouldn't be on the table at all — in any state.

In its 1868 decision Crandall v. State of Nevada, the Supreme Court ruled that states cannot impose taxes or regulations that burden the right of individuals to travel freely, including the modes of travel they use. The case specifically addressed Nevada's attempt to tax individuals leaving the state by various means of conveyance, such as stagecoaches or steamboats.

The right to travel freely is a fundamental right; as such, it is protected under the Privileges and Immunities Clause of Article IV and the Due Process Clause of the 14th Amendment.

The Court's reasoning was grounded in the principle that such taxes would infringe upon a fundamental right and exceed the permissible scope of state taxation powers.

Since all citizens have the right to move around freely, a state cannot impose taxes that interfere with their ability to leave.

The bottom line is the government does not have the right to charge you by the mile, no matter what these legislators may think. But legal niceties are of little interest to budding authoritarians looking for more cash from their subjects.

Now is the time to fight back against these laws before our rights as drivers — and as citizens — are eroded any further.

Originally Published at Daily Wire, World Net Daily, or The Blaze

What's Your Reaction?