Average American Family Pays Thousands in Hidden Taxes, Making Case for DOGE Even Stronger: Study

The government doesn’t just directly charge Americans in taxes—it also imposes a hidden tax that makes everything more expensive, according to a new report.

The federal government doesn’t just pass laws in Congress. Each year, many of the 438 federal agencies—nominally under the president’s control through the executive branch—publish tens of thousands of pages in regulations, red tape that increases the costs of business, transportation, and many other factors Americans often don’t consider.

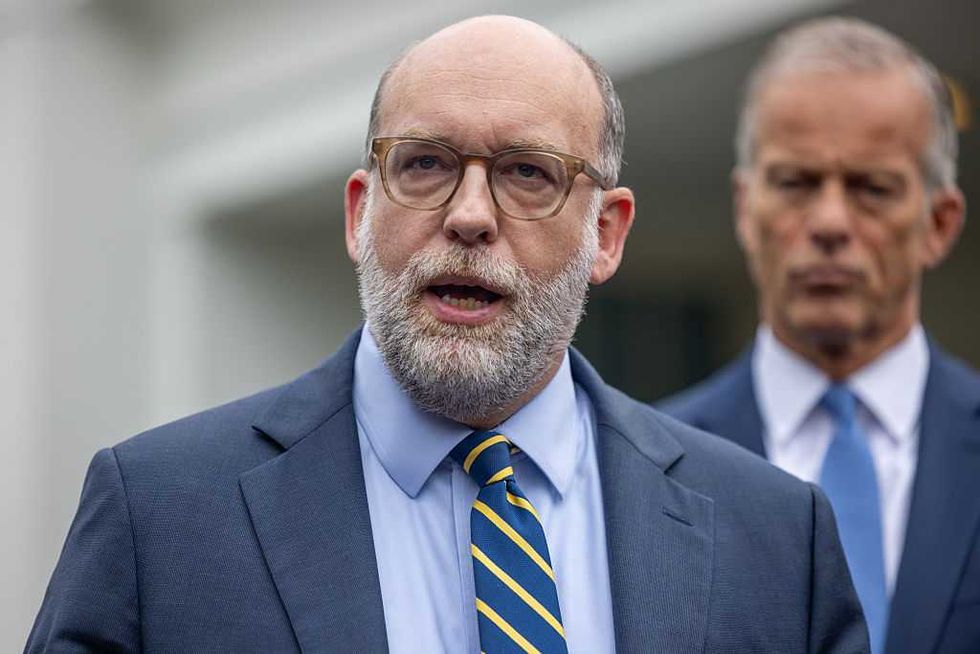

This imposes a kind of hidden tax that makes everything more expensive. It also justifies the work of the Department of Government Efficiency and other efforts to streamline the federal government, according to Clyde Wayne Crews, a fellow at the Competitive Enterprise Institute and author of the annual report, “Ten Thousand Commandments.” Crews released the 2025 version of the report on Thursday.

The report “directly and indirectly makes the case that DOGE or a successor entity—but especially Congress itself through legislation—should be more aggressive on deregulation,” Crews told The Daily Signal on Thursday.

According to the report, federal regulation costs Americans at least $2.155 trillion every year—a cost of $16,016 annually per household. This sum constitutes 16% of the average household’s pre-tax income, and 21% of household expenses. Most American families spend less than that on health care, food, transportation, entertainment, apparel, services, and savings. Only the cost of housing, an average annual household expenditure of $25,436, exceeds the costs of regulation.

“Ordinary income and FICA taxes are itemized on pay stubs and calculated on tax returns,” the report notes. “Most regulatory costs are embedded in prices of goods and services, and never show up on a receipt or an annual statement.”

While the exact cost of these regulations that gets passed down to the consumer is impossible to gauge, the report provides a rough estimate that highlights the overall phenomenon.

The regulatory tax of $2.155 trillion comes close to the federal income tax, which collected $2.176 trillion in 2023, and stands at about four times the corporate income tax of $419 billion in 2023.

The report notes that the $2.155 trillion figure is likely an underestimate. The National Association of Manufacturers ran a similar analysis in October 2023, concluding that regulatory compliance costs the economy $3.079 trillion each year.

Crews emphasized to The Daily Signal the “fusion of federal spending and federal regulation over recent years.”

“Since COVID-19, we’ve had the CARES Act, the CHIPS and Science Act, the Inflation Reduction Act, the infrastructure law, and more, and these are all hyper-regulatory before bureaucrats even start writing rules,” Crews added.

While the Constitution places the authority to make laws in the hands of Congress, federal agencies issue far more regulations than Congress passes laws. During 2024, for example, agencies issued 3,248 final rules, compared with Congress passing 175 bills. That means for every one law passed by Congress and signed by the president, unelected bureaucrats finalized 19 regulations.

My book, “The Woketopus: The Dark Money Cabal Manipulating the Federal Government,” exposes the leftist groups that staffed and advised the Biden administration, using this bureaucracy to force their ideology on the American people.

The Federal Register, the list of all rules promulgated by the administrative state, closed at 106,109 pages in President Joe Biden’s last full year, the highest tally on record and a 19% increase over 2023. Former President Barack Obama’s final calendar year saw 95,894 pages (the highest page count for federal regulations in U.S. history), while the administrative state only managed to publish 61,067 pages in 2017, the first calendar year of the Trump administration.

The gargantuan impact of the administrative state highlights the necessity of DOGE, according to the author’s report. Yet Crews also noted that DOGE has a sunset date—July 4, 2026.

“Note that DOGE goes away in a year, so there needs to be an infrastructure built that maintains the regulatory streamlining along with the slashing of spending,” he told The Daily Signal. “To me, real regulatory reform has to start with termination of departments and agencies.”

President Donald Trump has been terminating some agencies and departments—by directing that the U.S. Agency for International Development merge back into the State Department and by directing the ultimate closure of the Department of Education.

These changes save Americans money directly—with USAID grants terminated—but as the Trump administration decreases the size and scope of the federal government, that may also save American households money in decreased regulatory burdens.

The post Average American Family Pays Thousands in Hidden Taxes, Making Case for DOGE Even Stronger: Study appeared first on The Daily Signal.

Originally Published at Daily Wire, Daily Signal, or The Blaze

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0