Fed Chair Jerome Powell Hints At Possible Rate Cut, Wall Street Cheers

Federal Reserve Chair Jerome Powell suggested on Friday that central bank policymakers could cut interest rates at their meeting next month under current conditions.

Live Your Best Retirement

Fun • Funds • Fitness • Freedom

During a speech at the Fed’s annual Economic Policy Symposium in Jackson Hole, Wyoming, Powell said that “the balance of risks appear to be shifting” between the goals of full employment and stable prices, CNBC reported. Powell added that the labor market and the economy are in a good place, even as President Donald Trump’s tariffs take effect. Still, the Fed chair said that the tariffs present risks that must be considered, as inflation could rise.

The stock market spiked following Powell’s speech, with the Dow Jones and Nasdaq Composite rising 2%, while the S&P 500 was up more than 1.5%.

Powell said that the U.S. economy is in the middle of an “unusual situation,” with risks of a worse-than-expected labor market rising, according to The Wall Street Journal.

“And if those risks materialize, they can do so quickly in the form of sharply higher layoffs and rising unemployment,” Powell said.

The Federal Reserve often lowers interest rates if unemployment is high in an attempt to stimulate economic activity, which can lead to companies hiring more people. The year-over-year inflation rate of 2.7%, however, remains above the Fed’s 2% benchmark. The next inflation report is scheduled to be released on September 11, and the Fed is set to meet again to discuss interest rates on September 16-17.

End of Summer Sale – Get 40% off New DailyWire+ Annual Memberships

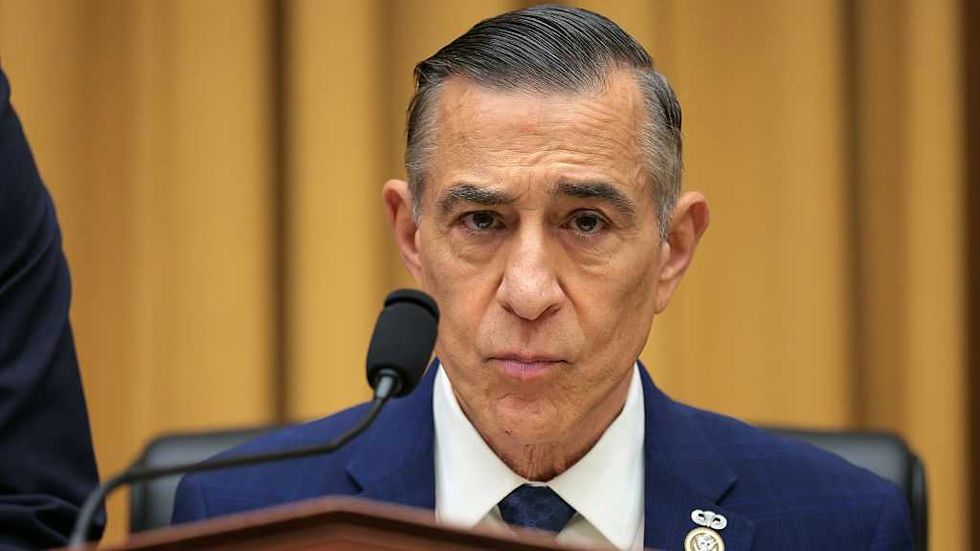

Powell has faced months of criticism from President Trump, who continues to urge the Fed to cut interest rates. Earlier this year, Trump threatened to fire the Fed chair, which would be an unprecedented move for a president to make, but Trump has backed off that threat, saying he will wait until Powell’s term is complete in May of next year to replace him. The Fed’s latest decision to keep rates steady also caused division among the policymakers, with two Fed governors, Michelle Bowman and Christopher Waller — who are candidates to become the next Fed chair — publicly disagreeing with the Fed’s July decision.

Trump’s latest knocks on Powell came on Wednesday when he said that Powell’s reluctance to lower interest rates was “hurting the Housing Industry, very badly.”

“People can’t get a Mortgage because of him. There is no Inflation, and every sign is pointing to a major Rate Cut,” Trump said.

The Trump administration is set to begin interviewing candidates for the next Fed chair after Labor Day, according to Treasury Secretary Scott Bessent. The administration has announced that 11 people are in the running for the position, including Fed Governors Bowman and Waller, White House National Economic Council Director Kevin Hassett, former Fed Governor Kevin Warsh, Fed Governor Philip Jefferson, Dallas Fed President Lorie Logan, former Fed Governor Larry Lindsey, and former St. Louis Fed President James Bullard.

Rick Rieder, BlackRock’s chief investment officer for global fixed income, David Zervos, the chief market strategist for Jefferies, and Mark Sumerlin, former deputy director of the National Economic Council, are also on the short list.

Originally Published at Daily Wire, Daily Signal, or The Blaze

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0