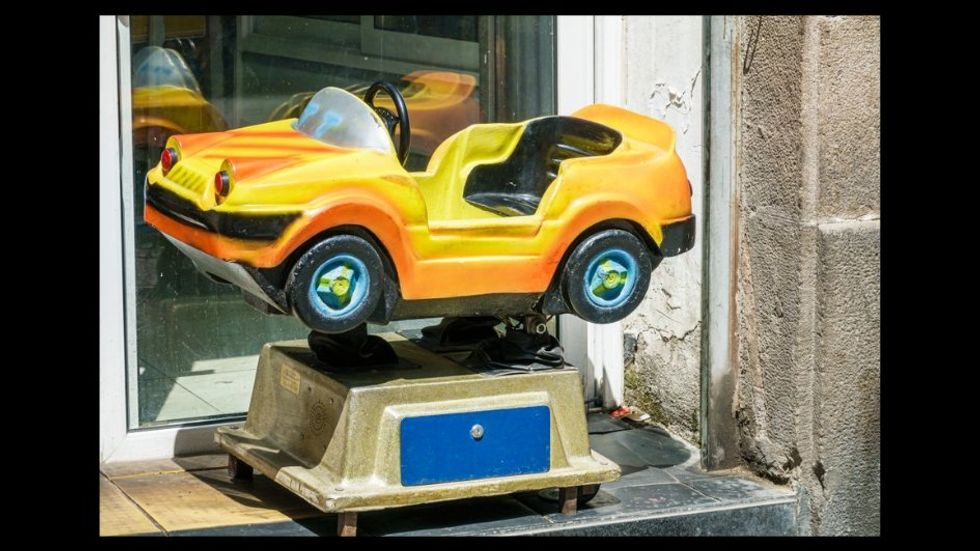

Fine-print fiasco: More carmakers charging subscription fees for once-free features

Hey, automakers: Enough with the upsells!

According to a new survey, most drivers are fed up with being asked to pay subscription fees for features such as heated seats or remote start that are already built into their cars.

Automakers argue that it’s about safety or innovation, but locking horsepower behind a $1,200 Mercedes paywall feels more like a shakedown.

This is a loud signal to brands like BMW, Ford, and GM. Are drivers done with the constant upsells, or could subscriptions still find a sweet spot? Here’s why consumers aren’t buying it, what automakers are missing, and how it shapes your next ride.

Missed connections

For its 2025 State of Connected Car Apps report, Smartcar (no relation to to Mercedes-Benz-owned Smart brand vehicles) polled over 1,000 drivers across the U.S. and Europe.

The findings: 76% won’t touch automakers’ connected services, free or paid.

Take Ford’s BlueCruise hands-free driving, for example: $495 a year after a 90-day trial. Or Mercedes’ $1,200 annual horsepower boost for EQ electric models. Even Toyota’s $8 monthly remote start fee.

After years of free trials and upsells, drivers surveyed in 2025 hit a tipping point. These features no longer feel optional but predatory. Yet 56% happily use third-party apps like Waze, which deliver real-time traffic data without fees.

Of the 24% who do subscribe, it’s nearly even: 49% pay, 51% get it free with the car. Meanwhile, 40% of drivers don’t even realize these services exist in their vehicles.

Hitting a wall

Automakers expect 96% of new cars to be “connected” by 2030 — Wi-Fi, apps, the works — but with three-quarters opting out, their strategy’s hitting a wall.

The resistance comes down to a few key issues. Subscription fatigue is real. Between streaming services and daily expenses, adding car fees feels like a breaking point. BMW’s 2022 attempt to charge for heated seats sparked outrage, and Smartcar’s data backs it up: 77% see these as pure profit plays, while 69% would switch brands to avoid paywalled features.

Imagine buying a $40,000 car, only to find the full stereo locked behind a $150 annual fee. It’s a hard pass for most.

Value is another sticking point. Cox Automotive’s 2023 survey showed 53% might accept subscriptions if they cut the car’s up-front cost, but back then, only 21% even knew the idea existed. By 2025, awareness has grown, but appeal has shrunk. AutoPacific data reveals EV buyers are slightly more open — 23% would subscribe — compared to 16% for gas cars.

Still, that’s a small group. Drivers want solutions, not revenue streams for manufacturers.

Privacy adds a darker layer. Mozilla’s 2024 report gave all 25 major automakers a failing grade on security standards. Cars track speed, braking, even phone contacts if synced, sharing it with manufacturers, insurers, and third parties.

Data sent to insurers can raise premiums based on hard braking or late-night drives, a reality that GM drivers faced in 2024 when habits were shared with LexisNexis without clear consent. Kaspersky’s 2024 survey found 72% of U.S. drivers reject this tracking, and 71% would opt for older cars to escape it.

Automakers argue that it’s about safety or innovation, but locking horsepower behind a $1,200 Mercedes paywall feels more like a shakedown. That explains the overwhelming pushback.

Cash cow

These companies are chasing big numbers. McKinsey forecasts $300-$400 billion in autonomous driving revenue by 2035, with subscriptions as a cash cow.

Tesla’s Full Self-Driving costs $12,000 up front or $200 monthly, while GM’s Super Cruise is $25 a month after three free years. Over-the-air updates unlock hardware already installed, like BMW’s heated seats. Cox Automotive found 65% like short-term trials, but 49% would keep cars longer if features didn’t vanish behind paywalls later.

There’s a glimmer of hope for manufacturers. Smartcar notes that only 11% are fully against subscriptions. Half would use more if prices dropped, say $5 a month instead of $50. Volvo cut its Care program from $1,800 to $775 for some models after pushback.

Value proposition

Brands like Subaru offer free Starlink safety alerts — crash detection and SOS calls — proving subscriptions can win fans when they prioritize drivers over profits. Navigation that outshines Google Maps or alerts that prevent collisions could shift the tide.

Basics like heated seats or stereo features are a different story. If those are locked, many would walk away. Used cars offer an out: 71% of Kaspersky’s drivers are eyeing older models to sidestep this trend.

The Smartcar report highlights a disconnect: 76% of drivers are drawing a line. Automakers have a chance to pivot, but it’s on them to prove subscriptions aren’t just another fee. Would you pay for these features, or is it a deal-breaker? Your take matters.

Originally Published at Daily Wire, Daily Signal, or The Blaze

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0