How the American Dream of Homeownership Became Unaffordable

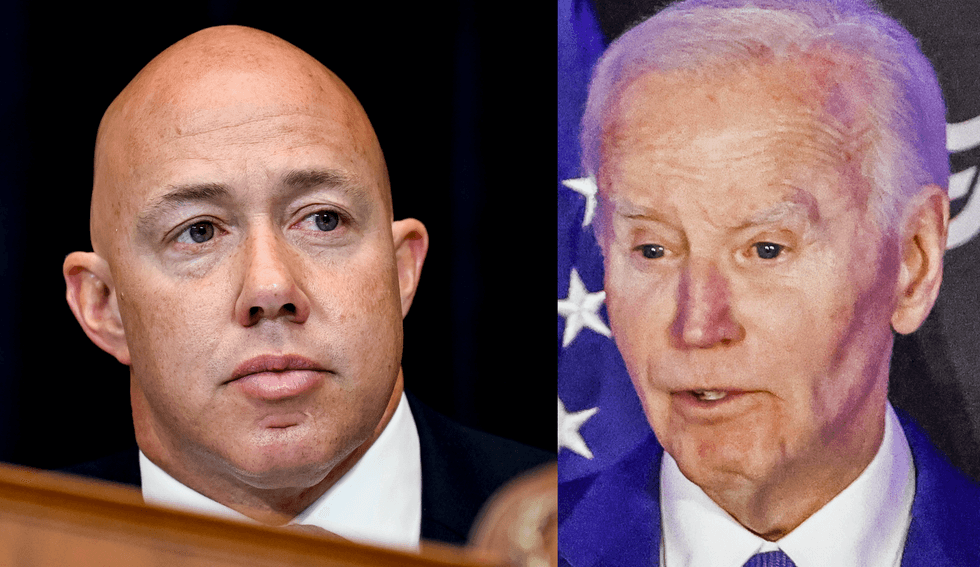

The following is a preview of Daily Signal Politics Editor Bradley Devlin’s interview with Rep. Pat Harrigan, R-N.C., on “The Signal Sitdown.” The full interview premieres on The Daily Signal’s YouTube page at 6:30 a.m. Eastern on Jan. 22.

Live Your Best Retirement

Fun • Funds • Fitness • Freedom

America has hit another record, but it’s not a good one.

Last year, the median age of the first-time home buyer in America hit 40 years old. In the 1980s, the average age of the first-time homebuyer in America was just 28.

What happened?

Higher interest rates in recent years have taken their toll, but today’s interest rates are nothing compared to the 1980s when the first time buyer’s age was much lower.

The answer is that housing prices have gone up, and for many different reasons. While an average house was around three times the average annual American wage, the average house now costs around seven times the average annual income.

Part of the reason that home prices have shot up is that large, multi-billion-dollar institutional investors are increasingly snapping up homes.

These institutions have crowded out younger families who can’t compete, which has contributed to older first-time homebuyers. It’s an issue that Rep. Pat Harrigan, R-N.C., has thought a lot about, and he joins us this week on “The Signal Sitdown” to explain how this happened and his proposal to fix it.

“During the Great Recession, you had the middle class losing their rear ends because they were getting underwater on their houses,” Harrigan told The Daily Signal.

In response, both the Bush administration and the Obama administration were, “really encouraging institutional investors to come into the market, particularly in certain zip codes. And in many respects that was actually very helpful because it actually propped up and helped to stabilize market prices, and probably prevented a lot of middle class Americans from getting kicked out of their homes, honestly,” Harrigan explained.

But in Harrigan’s telling, there was a cultural understanding that underpinned this new arrangement.

“There was also kind of a cultural understanding that as soon as the market stabilized, they were supposed to divest of those investments,” Harrigan continued. “Instead, they liked the appreciation, they liked the revenue coming in from it, and when you amass enough homes in a certain zip code, you actually start kind of controlling the market a little bit. And so, they actually bought more.”

These financial institutions have increased the number of homes they own by eight times since the Great Recession.

“At the end of the great recession, there were about a hundred thousand homes that were owned by institutional investors,” Harrigan claimed. “Today, by some accounts, it’s almost 750,000 homes across the country.”

“Just in my state of North Carolina, in Charlotte, 18% of the single family homes on the rental market are institutionally owned,” Harrigan added.

“I do think we can all recognize it’s now gotten to a point where it is crowding out middle class home buyers, particularly in certain zip codes across the country that are more popular than others,” Harrigan said. “That is having a very negative impact on the wealth-building trajectory of our middle class.”

As Americans pursue the dream of homeownership, they “shouldn’t be competing against the company that’s managing your 401k.”

“The longer that you delay somebody from getting into that first house, the longer you delay their wealth-building trajectory towards actually putting themselves in a very solid, fiscally responsible position, which is where you want the middle class,” Harrigan said of delaying homeownership.

In the House, Harrigan has just introduced the Families First Housing Act with Rep. Josh Riley, D-N.Y., in an attempt to give American families a leg up on institutional investors.

The Families First Housing Act, Harrigan explained, requires government entities auctioning homes “to provide 180 day first look to non-institutional investors.”

“We want to narrowly tailor this to get to a point where we don’t think it’s unconstitutional [or] gets thrown out by the courts at some point later down the road,” Harrigan added.

“I think that the solution that we laid out on the table, either in its current form or a slightly expanded form of it is something that’s palatable,” Harrigan said, “I think it’s something that’s reasonable. I think culturally it’s something that all Americans could say, ‘Yeah, I think that’s a good idea.’ And I think that that serves the interests of the middle class.”

The post How the American Dream of Homeownership Became Unaffordable appeared first on The Daily Signal.

Originally Published at Daily Wire, Daily Signal, or The Blaze

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0