India surpasses China in Apple exports to US, up 240% from last year

India has reportedly overtaken China in smartphone manufacturing in the second quarter of 2025, marking an unprecedented shift away from Chinese tech manufacturing amid an uncertain trade environment.

Live Your Best Retirement

Fun • Funds • Fitness • Freedom

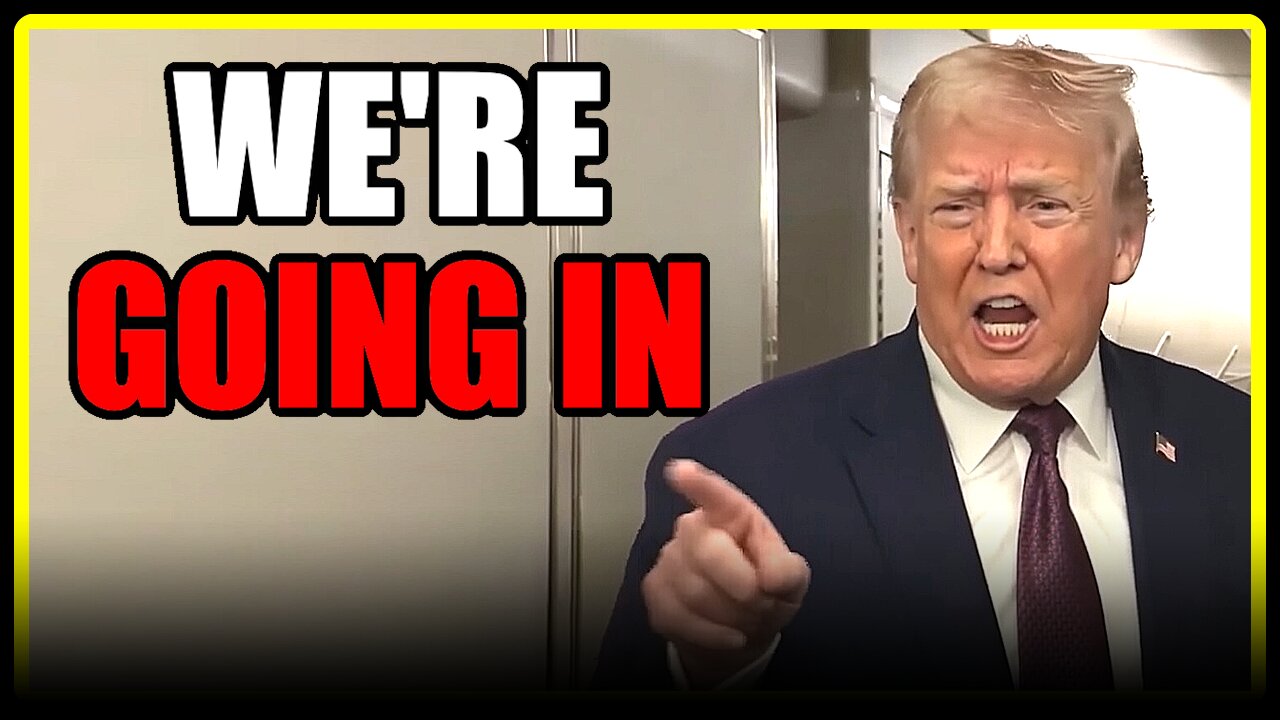

In the past six months, the Trump administration has shaken the global economy with aggressive tariffs and trade deals. Many companies have been forced to respond by adjusting their manufacturing practices, and the smartphone industry is no exception.

'Apple has scaled up its production capacity in India over the last several years as a part of its "China Plus One" strategy and has opted to dedicate most of its export capacity in India to supply the US market so far in 2025.'

According to a new report by research firm Canalys, the share of U.S. smartphone shipments dropped from 61% to 25% in the last year. The report goes on to say that India picked up this dramatic decline and smartphones made in India now account for 44% of the total volume of shipments to the U.S.

This marks a 240% year-on-year increase in the total volume of "Made in India" smartphones.

RELATED: Microsoft 'escort' program gave China keys to Pentagon

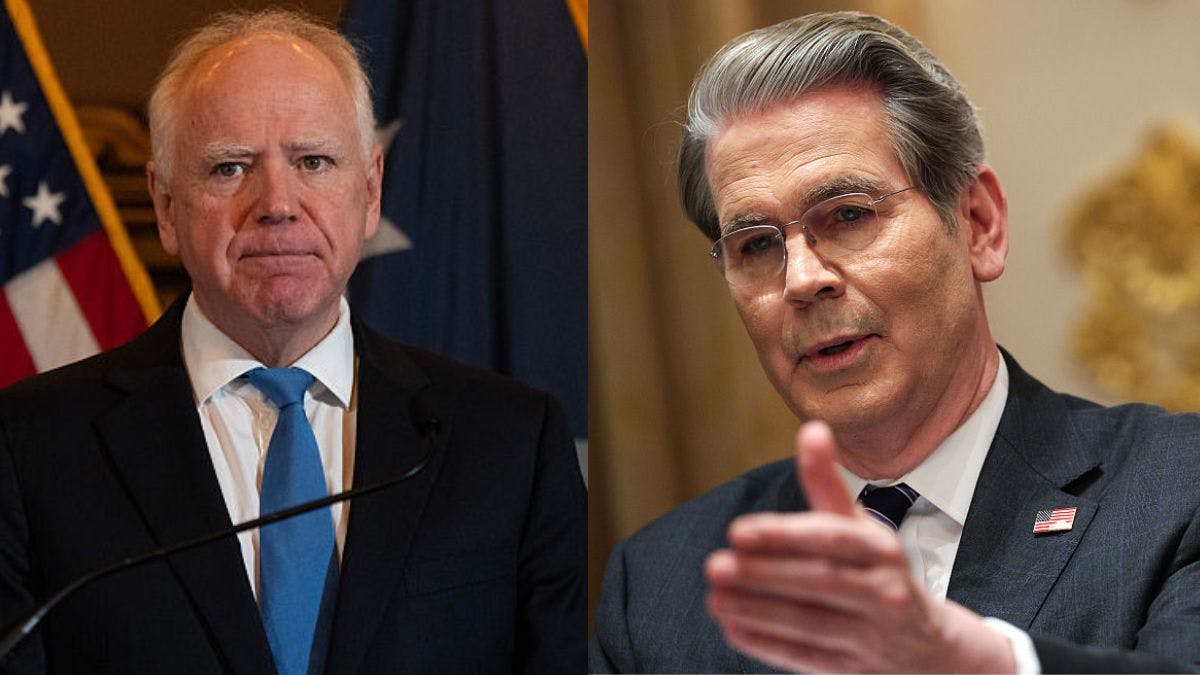

President Donald Trump signs a presidential memorandum targeting China's economic aggression on Thursday, March 22, 2025. Photographer: Andrew Harrer/Bloomberg via Getty Images

President Donald Trump signs a presidential memorandum targeting China's economic aggression on Thursday, March 22, 2025. Photographer: Andrew Harrer/Bloomberg via Getty Images

The Canalys report cited the "uncertain trade landscape" as a major contributing factor of this shift away from China during the ongoing tariff war between the United States and China.

"India became the leading manufacturing hub for smartphones sold in the U.S. for the very first time in Q2 2025," said Sanyam Chaurasia, principal analyst at Canalys, "largely driven by Apple's accelerated supply chain shift to India amid an uncertain trade landscape between the U.S. and China."

Many analysts have cited Apple's "China Plus One" strategy as a leading cause of this shift in its manufacturing diversification process. This refers to Apple's shift toward manufacturing in other Asian countries, specifically India and Vietnam. Vietnam has signaled that it is open to becoming a greater technology manufacturing hub, and Samsung relies more heavily on this country than other companies already.

"Apple has scaled up its production capacity in India over the last several years as a part of its 'China Plus One' strategy and has opted to dedicate most of its export capacity in India to supply the U.S. market so far in 2025," Chaurasia said.

As an AInvest analyst said, China Plus One "aims to mitigate the risks of over-reliance on a single region while leveraging lower labor costs in Southeast Asia."

China has been the manufacturing hub for Apple for many years, so fully untethering from the manufacturing giant may appear unworkable as a strategy to quickly shift to U.S. manufacturing at scale, which the Trump administration is pushing for. China is still the hub for premium product assembly and a key supplier of semiconductors, which complicates the prospect of a full disentanglement.

In March, Bloomberg reported that Trump had asked Apple to stop building out factories in India and instead to bring manufacturing back to the U.S. The company reportedly deemed this untenable for reasons including labor costs and the cost of scaling manufacturing infrastructure in the U.S.

President Trump has made a substantial effort to push companies to bring manufacturing back to the U.S., but the tariffs have led to differing outcomes as companies assess their long-term strategies.

"This is a familiar Trump tactic: He wants to push Apple to localize more and build a supply chain in the U.S., which is not going to happen overnight," Tarun Pathak, research director at tech analytics firm Counterpoint, told Bloomberg. "Making in the U.S. will also be much more expensive than assembling iPhones in India."

Apple did not respond to a request for comment from Return.

Originally Published at Daily Wire, Daily Signal, or The Blaze

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0