June Home Sales Drop Below Expectations As Trump Calls For Lower Interest Rates

Sales of previously owned homes dropped more than expected in June, according to the National Association of Realtors (NAR).

Live Your Best Retirement

Fun • Funds • Fitness • Freedom

Home sales fell 2.7% from May, lower than the 0.7% drop predicted by analysts, CNBC News reported. Sales fell to a seasonally adjusted rate of 3.93 million. There was no year-over-year change in home sales.

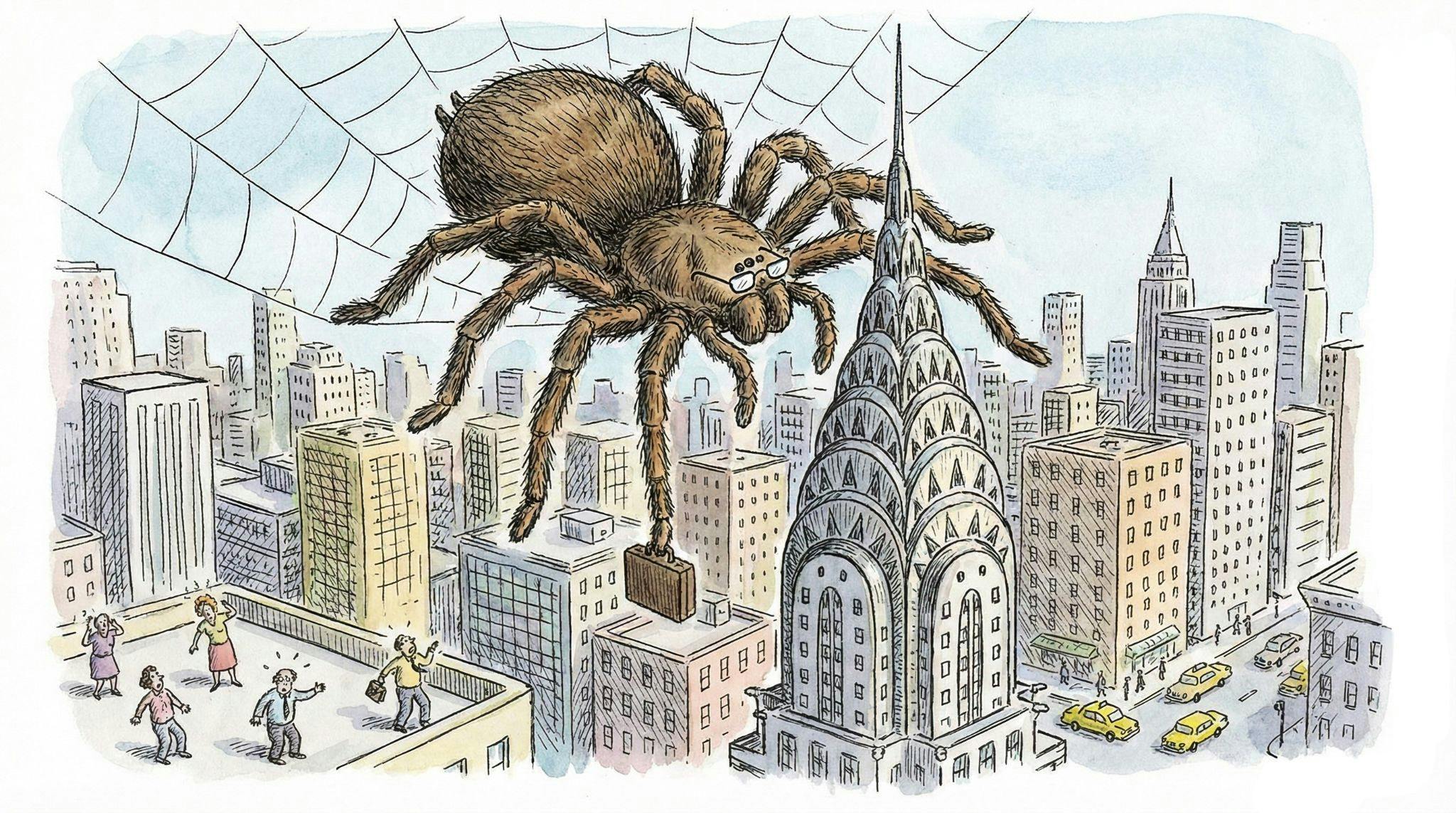

“High mortgage rates are causing home sales to remain stuck at cyclical lows,” NAR Chief Economist Lawrence Yun said in a statement. “If the average mortgage rates were to decline to 6%, our scenario analysis suggests an additional 160,000 renters becoming first-time homeowners and elevated sales activity from existing homeowners.”

The drop in home sales comes as President Donald Trump continues pushing Federal Reserve Chair Jerome Powell to lower interest rates.

“Housing in our Country is lagging because Jerome ‘Too Late’ Powell refused to lower Interest Rates,” Trump posted on Truth Social. “Families are being hurt because Interest Rates are too high, and even our Country is having to pay a higher Rate than it should be because of ‘Too Late.’ Our Rate should be three points lower than they are, saving us $1 Trillion per year (as a country). This stubborn guy at the Fed just doesn’t get it — Never did, and never will. The Board should act, but they don’t have the Courage to do so!”

Meanwhile, median existing-home prices reached a record high of $435,300, “the 24th consecutive month of year-over-year price increases,” according to Yun.

“Multiple years of undersupply are driving the record high home price,” Yun continued. “Home construction continues to lag population growth. This is holding back first-time home buyers from entering the market. More supply is needed to increase the share of first-time homebuyers in the coming years even though some markets appear to have a temporary oversupply at the moment.”

The average 30-year fixed-rate mortgage is 6.75% as of July 17, the NAR report said. The rate marks an increase from 6.72% the previous week but a decrease from 6.77% the previous year.

“Expanding participation in the housing market will increase the mobility of the workforce and drive economic growth,” Yun said. “If mortgage rates decrease in the second half of this year, expect home sales to increase across the country due to strong income growth, healthy inventory, and a record-high number of jobs.”

The Federal Reserve has resisted lowering interest rates, citing concerns that Trump’s tariff policies will increase inflation. Inflation rose 2.7% year-over-year in June, slightly more than expected. The Fed is reportedly not considering lowering interest rates at its July meeting.

Originally Published at Daily Wire, Daily Signal, or The Blaze

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0